A Couple Companies I'm looking at

I joined Substack in early May and have since been obsessively reading as many substacks as I can. Over the past two months I’ve found a bunch of great investors that write on this app and I read everything they write.

Below are 2 companies that I’ve recently started looking at (and created starter positions in each) that I found from 2 different investors on Substack. I only wrote a little bit about each company so of you’re interested in either of them I highly recommend to read the other investor’s sub stacks. These two substacks are free and are my current favorite substacks to read.

Company - BQE Water

Substack- Raging bull Investments

Market cap - 52 million (USD)

Raging bull investments is one of my favorite free Substack creators and I highly recommend you read some of his writeups.

BQE is an asset light business that provides water treatment for mines. They create the water treatment solutions for the mines and the mine pays for the Capex for building of the water treatment system. This is a highly sticky business as BQE has to create a new water treatment solution for each mine and mines have an average life span of 30 years. They’ve grown their recurring revenue by over 60% since 2019 and they have basically zero debt.

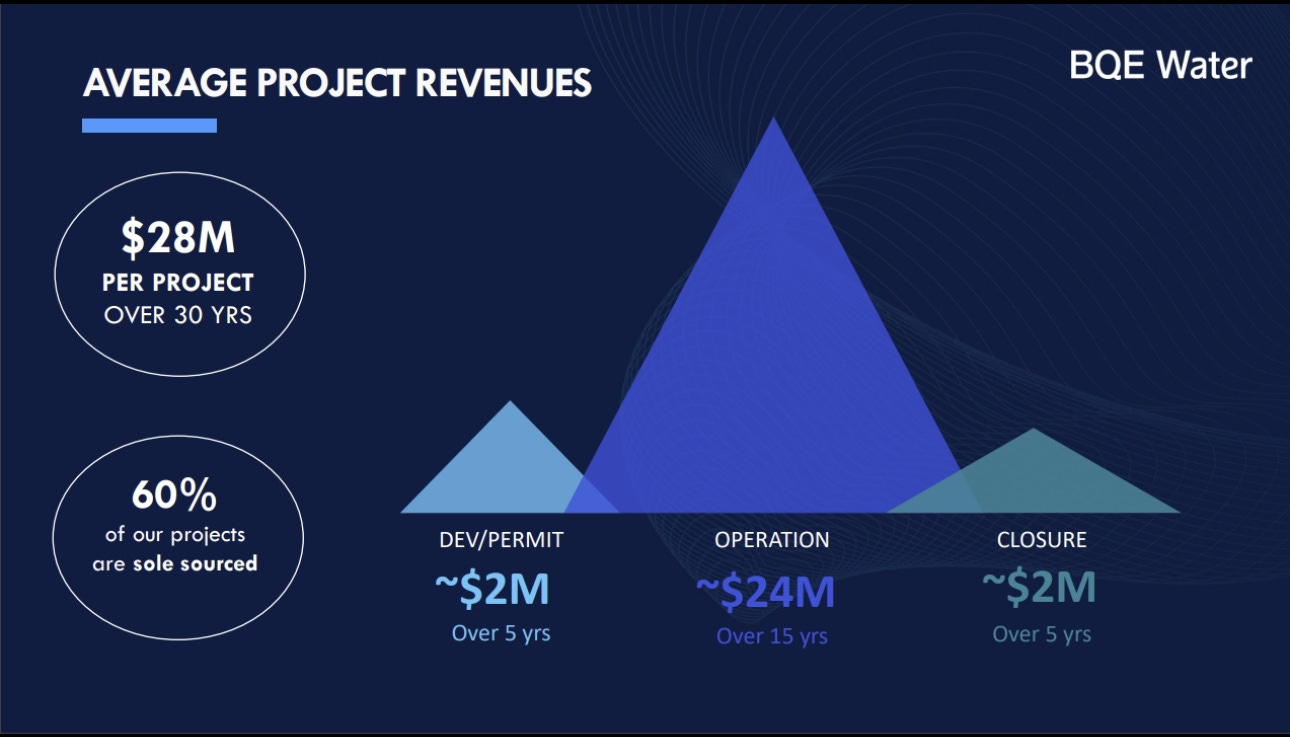

They estimate that they make $28 million from a project assuming it last for 30 years and they are trying to do 2 to 4 new projects a year.

They also have what they call “company maker projects”. Company maker projects are projects to my understanding that are the same as regular projects but are much bigger than the average project. Projects of this size are obviously massive for BQE considering how small BQE currently is.

I’ve glossed over a lot of details like their joint venture in China, their non organic selenium solution, and didn’t even mention any financials. So I’d highly recommend you read Raging Bull’s first article and second article if you’re interested in learning more about this stock. Also BQE’s management has done multiple interviews that are on YouTube including this recent one with planet microcap.

2- Natural Resource Partners

Substack- Special Situation Investing

Market cap- 1.2 billion

Special Situation Investing is also one of my favorite free Substacks and something I love about their Substack is that they turn every article into a podcast so you can listen to the article instead of reading it.

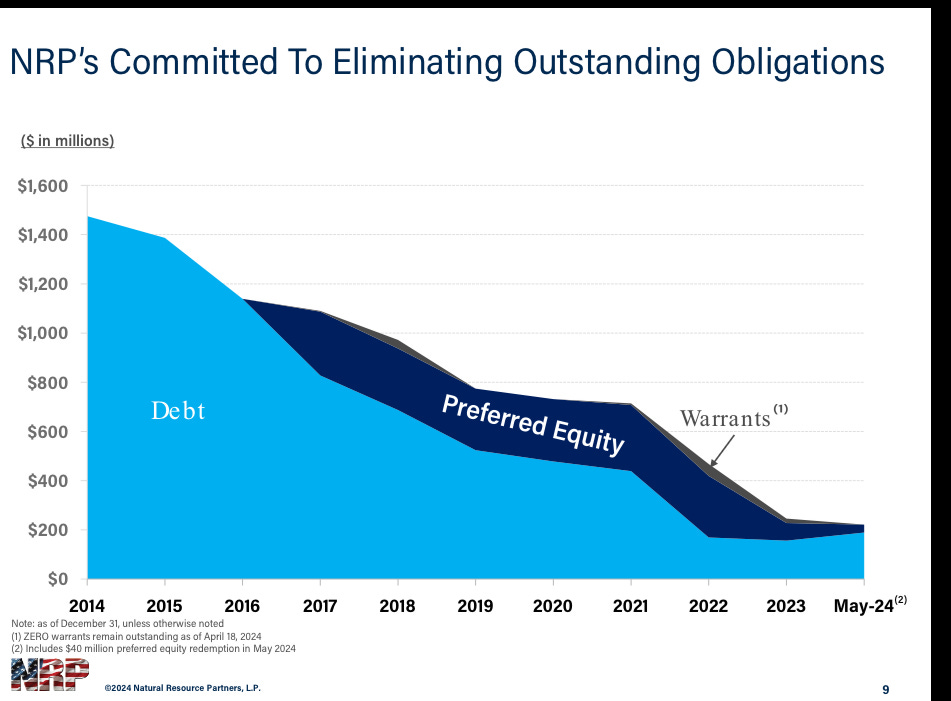

NRP is a coal royalty business which rents out its land to coal companies and owns 13 million acres of land which is equal to roughly 20,000 square miles. They have been paying down their debt from $1.5 billion in 2015 to $260 million now.

Management has stated multiple times that their goal is to pay down all their debt and then return all free cash flow to shareholders.

They are very clear if you read any of their letters that they don’t do any of the mining and all they do is collect royalties from the companies mining on their property. This results in minimal operational costs and a very high free cash flow. This translates to a nice valuation of 4x LTM FCF.

Management has said that they’re unlikely to make as much FCF as much as they have recently but are still focused on paying down the rest of the debt.

“While we expect lower prices for coal and soda ash to drive our free cash flow in the coming quarters below the record levels realized in recent years, we expect to continue making steady progress paying down debt and preferred equity.” - Craig Nunez Q1 2024 (NRP’s Chief Operating Officer)

Despite them not likely to be able to put up record FCF numbers they are still trading at a cheap price. If you average out the FCF from 2015 to 2023 they make on average $158 million in FCF which would equal a P/FCF of 7.59.

Special Situation Investing has a few incredible articles explaining the ins and outs of this company. In these articles they also explain their thoughts on the coal industry and what the future of the coal industry is. I linked 4 of their articles on NRP below but they’ve also talked about NRP in some of their portfolio update articles.

Article 4

We happy you find our work useful. Nice summary.