1- Valeura Energy

Ticker- $VLE.TO

Market cap- $475 million

Valeura Energy is focused on the production, development, and exploration of oil and gas in Thailand and Türkiye. They’ve had some highly value-accretive acquisitions including acquiring the oil production of 20,000 barrels a day for just $10 million.

I think in just 5 bullet points I can make you interested in this company.

$156 million in cash and it seems management wants to make another acquisition

$400 million in net operating losses which should help increase the next few years of free cash flow

Reserve replacement was over 200% in 2023 and they extended the lives of all the fields

Share buyback program for 7.3 million shares which is 10% of the free float

They expect cash flow to exceed enterprise value by the end of 2025

If this isn’t enough there has been a ton of insider buying in the past 3 months.

This video on YouTube of the CEO going through the investor presentation is a great way to start researching the company.

and both have write ups on this company and rubicon59 has written a lot about the company on X.Disclosure- I’m currently long shares of $VLE.TO

2-

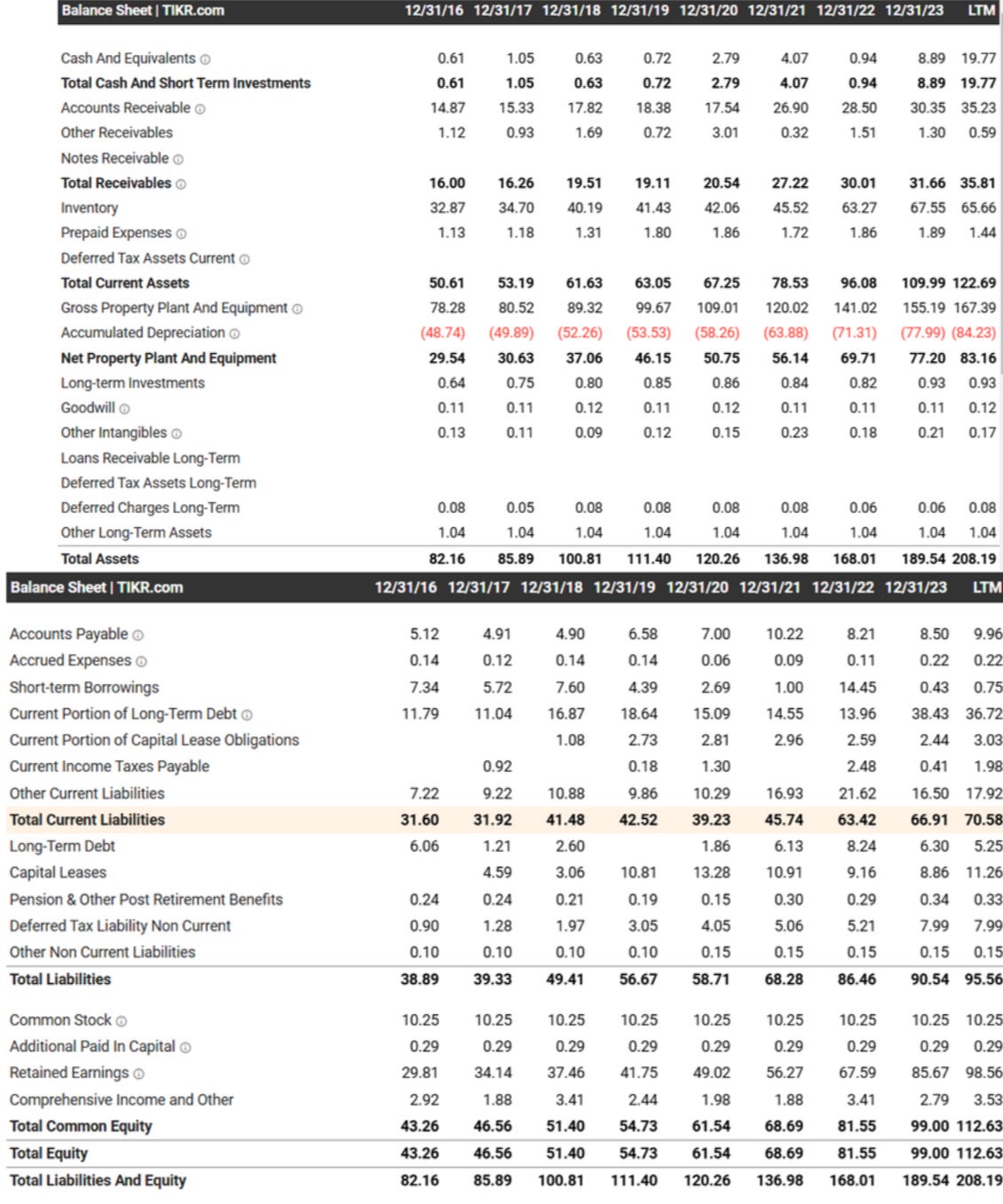

Every once in a while, I try not to look at a company's market cap and instead give it a valuation based on its financial statements. That’s what we’re going to do. Try to do some napkin math and put your answer in the comments. No cheating!

All numbers for this company are in CAD unless specified otherwise.

If you thought anything above CAD$ 118 million you might want to check out this company. This is also without mentioning the real estate they own which is arguably worth more than the companies market cap.

Hammond Manufacturing ($HMM.A)

Market Cap- CAD$ 118 Million

Hammond Manufacturing was established in 1917 in Ontario, Canada. The company specializes in producing electronic and electrical enclosures, outlet strips, electronic transformers, etc., which are used by manufacturers across a wide range of electronic and electrical products. Their products are sold directly to Original Equipment Manufacturers (OEMs).

Smoak Capital wrote about $HMM.A in their 2023 annual letter and Alluvial Capital has also mentioned them in a letter.

3- PagSeguro Digital

Ticker- PAGS 0.00%↑

Market Cap- $2.37 Billion

PagSeguro Digital provides financial and payment solutions for consumers, entrepreneurs, and small businesses in Brazil and internationally. Its services include digital banking, payment processing, debit and credit cards, loans, and insurance.

There are currently quite a lot of high quality companies in Brazil that are trading at cheap prices especially after the new income tax reforms that have been proposed.

PAGS is no exception as since 2016 they’ve grown their revenue at a 49% CAGR and their net income at a 37% CAGR.

Despite this grow PAGS trades at NTM P/E 6x, NTM EV/EBITDA 3.6x, and slightly less than book value.

The company has also bought back $100 million of stock since August and still have over $100 million left in their buyback program.

They’re expecting revenues to grow in the high single digits over the next couple years and it’s important to remember they have a lot of competition.

The

and have both written about $PAGS.A Few Extra Ideas

$MOUR - construction company with negative working capital, with a 22% ROIC, trading at 8x earnings.

wrote a great write up on the company$HRBR- trading below net cash

$3321- A very interesting Japanese net-net.

has a great write up on this companyCRON 0.00%↑ - A cannabis net-net that is ridiculously cheap.

has multiple amazing write ups on the company. (I’m long)The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions.

Thanks for the recognition. Much appreciated.

With regards to LATAM stocks, just remember multiples can remain depressed for as long as anti-capitalist governments remain in place. Good old fashioned value investing based on yield + a lot of patience is required.

¡Mucha suerte a todos!

Looking into VLE:

"They expect cash flow to exceed enterprise value by the end of 2025" - this seems very outdated. How much cash flow do you see them doing in 2025? Surely not much more than $200m, let alone $600m right?

Any napkin math on FCF based on their current assets for the next few years?

I was looking at @almostmongolian's write-up and also doing my own calculations. Conservatively I see them doing anywhere between $50m and $220m.

$50m FCF = based on 20mbbls/d * $70 oil price

$220m FCF = based on 25mbbls/d * $80 oil price.

Using 12,5% royalties, $220m OpEx and $130m CapEx.

And that is with the tax credits, which will probably last 2 to maybe 4 years after which the economics change a bit.

I think as long as oil price doesn't drop below $70 and they can keep production near 25mbbls/d the cash flow is really great. Otherwise it's really gotta come from their M&A. What are your expectations around production and oil price?