A Nanocap REIT trading at 0.37x P/B with a 8.4% Dividend Yield

With half the market cap in cash

About 2 months ago, the Multibagger Monitor (I highly recommend you follow him as he’s a great investor) made a post on X sharing a few interesting ideas and his thoughts about them. For this company he wrote “Tiny cheap REIT with a great dividend, but probably too small and might be impossible to buy”. This immediately caught my attention, so I decided to take a closer look at the company— and this is exactly what this write-up is about.

Sun Residential Real Estate Investment Trust

All numbers are in USD unless specified otherwise

Ticker- $SRES.V

Market Cap- $5,547,515

Enterprise Value- $35,106,742

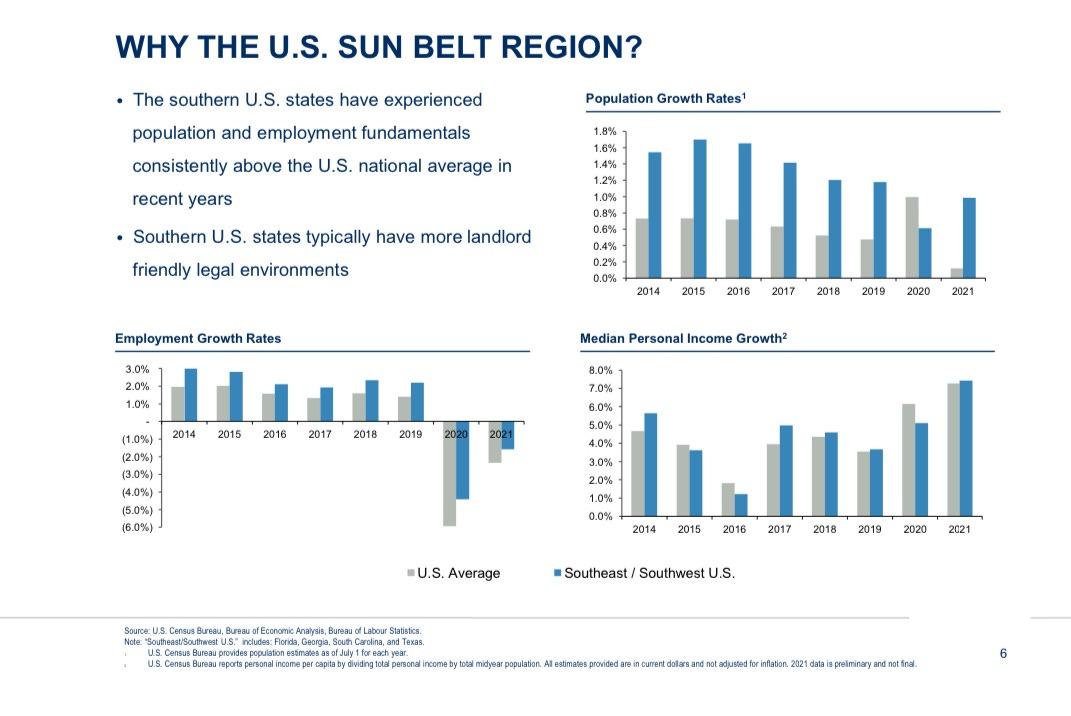

Sun Residential is an open ended REIT based in Canada that buys multi family residential properties in the Sunbelt region of the United States. They like the Sunbelt region because of its population growth and landlord friendly legal environment.

They currently own only two properties, both located in Florida. In the most recent MD&A, management said neither their employees or properties were harmed by Hurricane Milton.

In June 2023, they purchased an abandoned eight unit building in Cape Coral for $867,684 after it had been heavily damaged by Hurricane Ian.

This property is currently being renovated and management is hoping the property will be operational by the end of 2024.

To this end, in 2023 we acquired 4815 Tudor Drive, a small apartment building that had been severely damaged by Hurricane Ian. Renovation work is underway and management anticipates that the building will be operational before year-end. - Q3 MD&A

So far they’ve spent a total of $1.46 million on this property which includes the price of the building, acquisition costs, and repairs/additions.

Evergreen at Southwood

In January 2020 they acquired 51% in Evergreen at Southwood with Westdale Asset Management having a 49% stake. In total they paid $53 million for the property which was comprised of $11.18 million in cash, $31.4 million mortgage, and a non controlling interest (Westdale) valued at $10.7 million. This property has a total of 12 buildings with 288 rental units. It has various amenities including a gym, dog park, and a pool.

The occupancy rate since they’ve owned the property has ranged from a low of 89% to a high of 98%. At the end of Q3 the occupancy rate was 95% but in the Q3 MD&A they say their current occupancy rate is 98%.

Overall it appears that tenants enjoy the apartments as they have 4.3 stars on Google Maps and have a lot of very positive reviews. Something I like about the reviews is that it appears that Westdale is doing a great job taking care of the property and of the tenants.

Since Evergreen is their sole operational property, all revenue and NOI figures are exclusively from it.

Their revenue and operating income have increased every year since acquiring Evergreen, with AFFO also growing every year except in 2022 due to a one-time CapEx cost which was maintenance/repairs on the HVAC and pool. They have a NOI margin normally hovering in the mid 50s with it currently being 51.7%.

Based on their Q3 2024 earnings their balance sheet is in a great position. They have a current ratio of 14.37 as they have over $3 million in cash and just $299,693 in current liabilities. They have $60 million in investment properties and their long term debt is made up of $1 million in deferred income tax and $31.4 million on the mortgage for the Evergreen property.

The mortgage has great terms, making SRES more attractive than it might initially appear. It has an annual interest rate of just 3.52% and is structured as interest-only until 2029, at which point the full balance becomes due in a lump sum. Currently, the mortgage's fair value stands at $27,617,000, compared to a carrying cost of $31,440,000.

SRES currently pays an annual dividend of CAD $0.0038 (less than a penny). While this may seem small, with SRES's current share price at CAD $0.045, the dividend yield is at 8.4%.

SRES aims for a 90% AFFO payout ratio but they’re currently above 100%. I’m not too worried about this as they’re likely to increase AFFO when the new building becomes operational and they have plenty of cash.

Valuation

SRES trades at 0.38x P/B, LTM P/AFFO of 11.3x, with a 8.4% dividend yield. While this is already a pretty cheap valuation this is without the earnings from the building on Tudor Drive which is expected to be operational by the end of 2024.

They have the property valued at $1,225,000 on the books and using the 6.75% cap rate that management values the property with we get $82,687 in potential NOI. They have invested $598,997 in property additions to date, with these expenditures likely to stop once the property is completed and ready for use, which should significantly boost free cash flow in the coming quarters.

While this isn’t a dirt cheap valuation it’s still very cheap with a likely boost in cash flow when the second property becomes operational and is no longer eating up cash.

Risks

Hurricanes are a pretty big risks as the Tudor Drive property was already hit by a hurricane which was why they were able to get it for so cheap. While neither hurricane this year damaged their properties, it still is a big risk as Florida has the most hurricanes of any state in the US.

REITs tend to dilute shareholders to fund new deals which they did for the Evergreen property but didn’t have to do for the Tudor Drive property.

The Tudor Drive property is a failure and is never cash flow positive.

A bad acquisition could really destroy this business, but management has been careful in acquiring buildings. I haven’t researched management as much as I’d like to so I’ll probably write a bit about them in the subscriber chat when I’m finished my research.

Conclusion

As the Multibagger Monitor said, this is a cheap REIT with a great dividend, but it can be tough to build a position because of low liquidity. Lately, there’s been more liquidity than usual, but there are still days when no shares trade.

I’ll be keeping an eye on it, specifically for any news about the Tudor Drive property becoming operational.

Disclosure- I’m currently long shares of Sun Residential Real Estate Investment Trust

The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions.

Congrats - one I saved ages ago but never got round to looking into and now I'm kicking myself!