Quick Pitch

87% Recurring Revenue

7x FCF

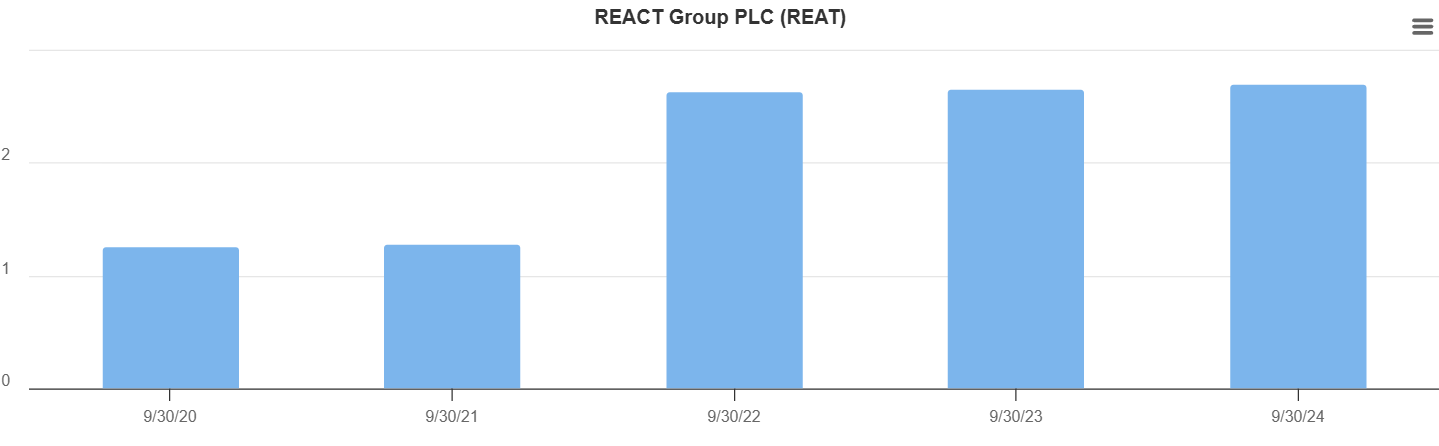

Revenue has grown from £4.36 million in 2020 to £20.7 million in 2024

3 year goal of doing £5 million in FCF per year

React group ($REAT.L)

All numbers in this write-up are in British Pounds unless specified otherwise

Market Cap- £17.25 million

Enterprise value- £16.26 million

React group is a specialized emergency cleaning business that focuses on cleaning hazardous or urgent situations which need to be cleaned by someone with specialist expertise. They operate nationwide in the UK 24/7/365, with a lead time of 2 to 4 hours.

This includes cleaning up after a person has been hit by a train, clearing drug dens, and cleaning prisons and the custody cells.

In 2019, about 30% of their revenue was recurring, as they had some contracts with hospitals to clean rooms that had been contaminated with deadly diseases.

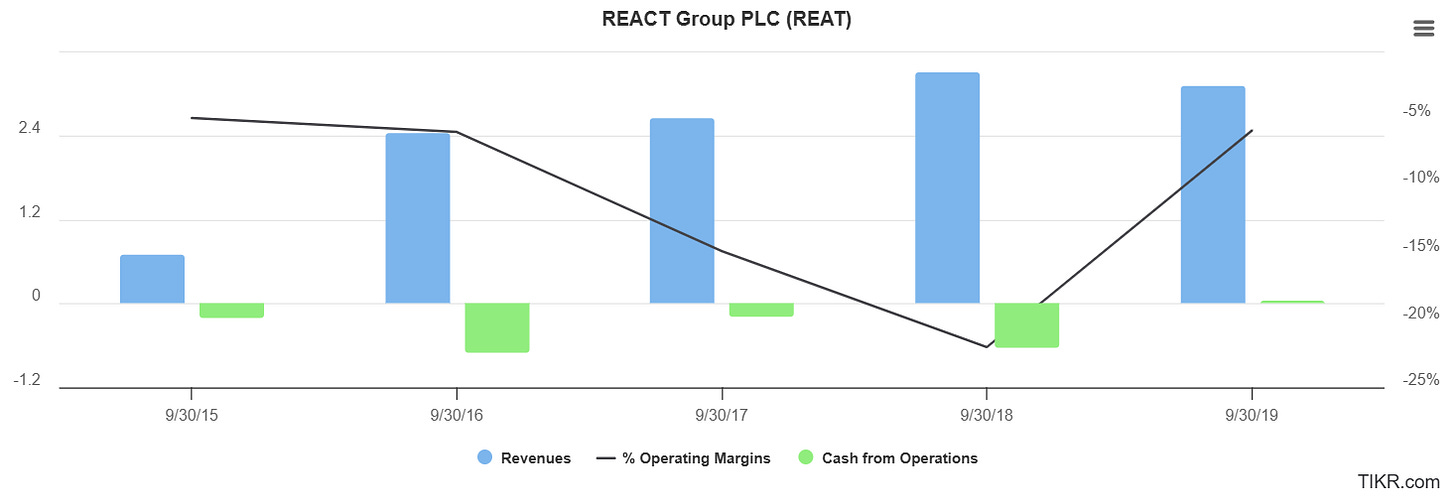

While React’s revenue was growing, they couldn’t generate any operating profit and only had positive cash flow from operations in 2019 of £300,000.

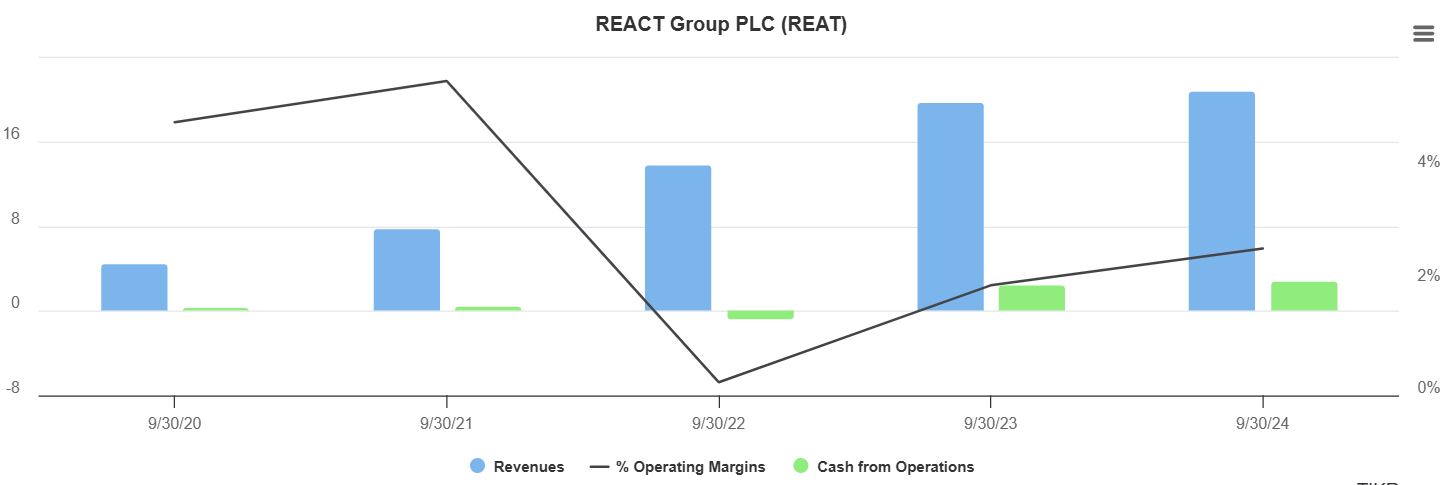

Then, in 2020, Mark Braund was appointed executive chairman, and Shaun Doak was appointed CEO. Shaun Doak is a sales expert with over 20 years of sales experience and has helped the business grow organically while Mark Braund focused on growing recurring revenue by finding businesses to acquire. These acquisitions have expanded the total amount of services React offers, have had some great synergies with the core business, and have increased the company’s recurring revenue.

Acquisitions

Since Mark Braund has become the chairman he’s acquired 3 businesses.

Fidelis

Fidelis provides contract cleaning and hygiene services, including daily housekeeping, washroom hygiene, building and caretaker services, as well as specialist services like kitchen and duct cleaning, industrial deep cleaning, and pest control.

Their clients are mainly in the education and healthcare sector and no client makes up more than 8% of their revenue.

When they were acquired they had 87% recurring revenue and most of their contracts were between 3-5 years long and had a history of contract renewals including a college this year for £3.8 million over 3 years which is almost double the value of the original contract.

Fidelis was acquired in March 2021 for a total of £4.75 million after hitting their performance target which ended up being about 4.75x EBITDA.

Since React acquired Fidelis, Fidelis' revenue has more than doubled, and their recurring revenue has slightly increased to 90% of their total revenue.

Laddersfree

(React bought Laddersfree in May 2022)

Laddersfree is a asset-light commercial window cleaning business that uses a network of over 300 local window cleaning specialists to provide window cleaning, power washing, and cladding cleaning.

They have some big name clients like Holiday Inn Express, Marriot, and Jury’s Hotels.

They have 4.7 stars on Trustpilot and the reviews talk about how Laddersfree is the cheapest window cleaner they have found and how high quality their cleaning is.

100% of their revenue is recurring with contracts being 1-3 years with most contracts on a rolling 12-month basis. 86% of their revenue came from large nationwide customers that had zero churn in the five years leading up to the acquisition.

React acquired Laddersfree for £8.5 million which was 5.5x EBITDA which was the most expensive acquisition to date but also likely the best business they bought due to the asset-light model and the 100% recurring revenue.

24hr Aquaflow Services

Note- Since this company was acquired in October 2024 which was after React’s latest financial statements the cost of the acquisition is not reflected on the company’s balance sheet.

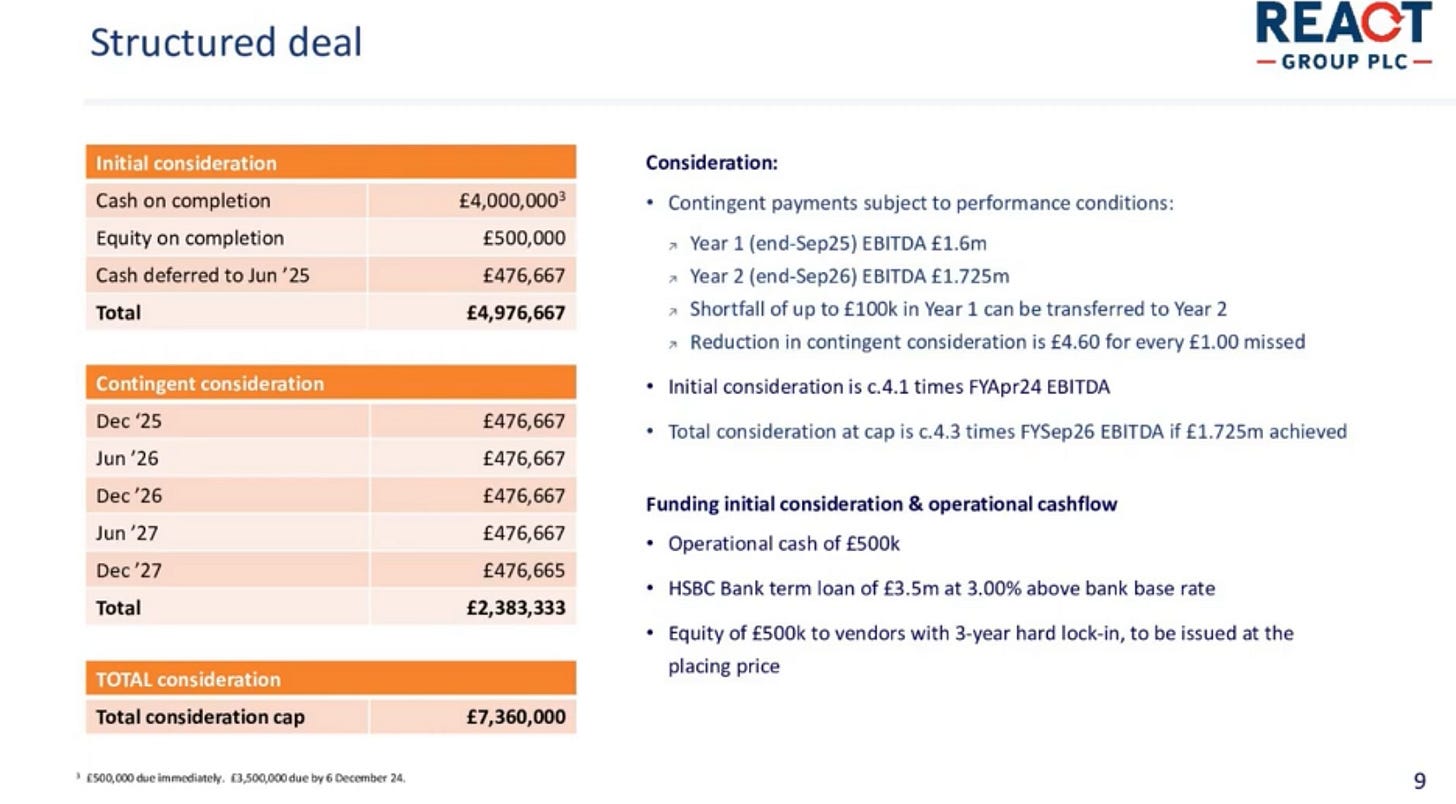

React Group acquired Aquaflow, a plumbing and drainage services company primarily operating in London and the Southeast of England, for an initial £4.97 million. The total consideration could rise to £7.36 million if Aquaflow achieves £1.72 million in EBITDA by 2026.

In 2024, Aquaflow generated £6.1 million in revenue, up from £4.7 million in 2023, with EBITDA increasing from £1 million to £1.2 million. React’s CEO confirmed that the company is cash flow positive.

Mark Braund said in a recent interview that Aquaflow has between 50% and 60% recurring revenue and has great synergies with their React business.

When Aquaflow completes a drainage service, it leaves behind a mess that has to be cleaned. This allows an easy cross selling point and Mark has said just a week after acquiring Aquaflow they cleaned up after a drainage that Aquaflow did.

Since 2020 React has grown its revenue from £4.36 million in 2020 to £20.7 million in 2024 with cash from operations going from £280,000 to £2.79 million with cash from operations only being negative in 2022 because of the change in working capital.

FY 2024

Their full year ended September with revenue of 20.79 million up from 19.5 million in 2023 with recurring revenue staying at 87%. The underlying organic revenue growth was 11% but a contract they signed during covid had ended as they no longer needed Reacts specialized services.

Their gross margin improved slightly to 27.6% from 26.8% in 2023 and this will likely improve again next year as Aquaflow has 56% gross margins.

In 2024, they had £2.79 million in cash from operations (£1.65 million in owner earnings).

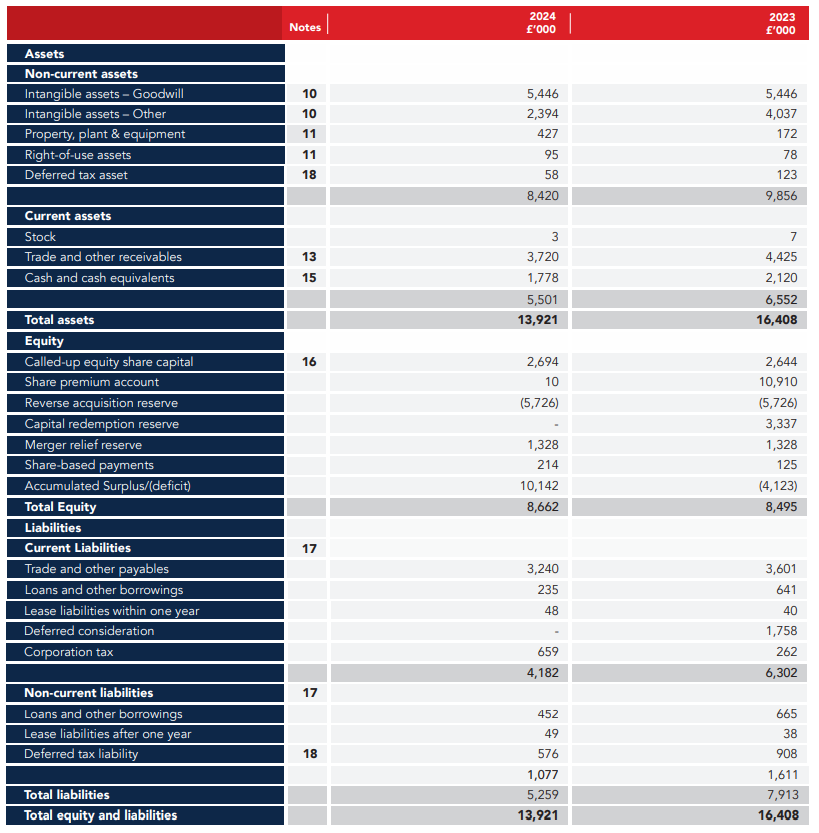

As of September 30, React’s balance sheet was very clean with £5.5 million in current assets to £5.25 million in total liabilities

However, their current balance sheet is very different as this was before the acquisition of Aquaflow.

Free Cash Flow Goal

Management previously set a free cash flow goal of £5 million within 3–5 years, but after acquiring Aquaflow, they have moved up this target, now guiding for more than £5 million within the next three years.

Management had also set FCF goals in 2023 and in 2024 and they surpassed their FCF goal both times.

Risks

Besides the obvious business risks, there are two major risks with this company.

Key Man Risks- Mark Braund is a major reason for the turnaround and the success of React since 2020, particularly with the three key acquisitions that have significantly grown the company's capabilities and recurring revenue. If he were to leave, I’d be very concerned about the company's ability to hit its FCF target and to be able to make good acquisitions.

Shaun Doak has also been a great CEO so if he leaves it would also be a red flag but not as much as Mark leaving.

Dilution

The share dilution is by far the biggest knock on the story as the shares have been diluted at a 23% CAGR since 2020.

Now the dilution wasn’t for no reason as they had to dilute to acquire the businesses and as the acquisitions have worked out well the dilution has been worth it as FCF has grown at a 43% CAGR since 2020. But if they overpay for an acquisition or if a acquisition fails, it could severely affect the company's financial health and growth trajectory.

Management also holds a significant number of share options from when they joined the company, with these options vesting between £1 to £2 per share.

Conclusion

While React isn’t a screaming buy, it’s interesting enough to be on my watchlist. I’m waiting to see if the Aquaflow acquisition works out and if they stop diluting.

Things to Note

React amortizes the acquired companies customer list over 4 years

The share price has dropped recently likely because Canaccord Genuity Group sold 1.16 million shares in January cutting their position in half

Mark is expecting another acquisition or two in the next couple of years

CapEx is going to rise because of Aquaflow by about £150,000.

They are well diversified, with over 1,200 customers with no singular customer contributing more than 8% of their revenue

React has been developing “Project Sparkle” which is a digital platform “to automate, support and scale the nationwide commercial window cleaning business.” They expect this to be fully rolled out this month.

Disclosure- I don’t currently hold any shares of React

The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions.

First of all, thanks for your write-up. I enjoyed the article and digging deeper into the company. I have a few questions and would like to hear your opinion:

The company amortizes acquired customer lists over 4 years, despite emphasizing a very low customer churn rate and high recurring revenue. I am not sure if this is IFRS-compliant because the amortization period must correspond to the asset's economic useful life.

The 13% discount rate applied in impairment tests appears excessively high for a stable cleaning business with predictable cash flows. Do you think these accounting practices are still legal, and what could happen if the regulatory authority concludes they were too aggressive?

The guidance is £5+ million FCF in 3 years. Are there any projections on how high the dilution will be by then, and what is your opinion? If the company doubles the share count, the high FCF won’t create significant value for shareholders. The high number of options granted over the last 2 years (approximately 2 million) seems concerning. Furthermore, the company pays very little in taxes due to the high amortization charges. At some point in the future, they will have to pay more taxes, which will reduce the FCF.

I knew from the title alone.. so cool to see someone else give this name a look. Been following for about 10 months. Good write up. Would love to connect further to talk about it.