Table Trac ($TBTC)

Market Cap - $18.56 million

Enterprise Value- $12.19 million

Table Trac creates casino management systems (CMS) that help casinos manage their day-to-day operations like tracking table games, managing slot machines, rewarding players, and handling accounting. The company was created by Chad Hoehne in 1995. He is the CEO of the company and owns 25.3% of the company.

Table Trac currently has 6 products.

TableTrac System - The TableTrac System automates and monitors operations of casino table games. The system allows real time tracking of the table games and streamlines all the pit management operations on one touchscreen.

CasinoTrac - CasinoTrac is the central CMS that automates operations including, guest rewards, promotions, cage management and audit/accounting. The system also helps track revenue and activity on all machines in the casino, creates player profiles, and create promotions based on the players data.

DataTrac - Provides detailed analytics and performance metrics

KiosTrac- Self-service kiosk where players can sign in and reprint loyalty cards if needed without needing to wait by the service desk.

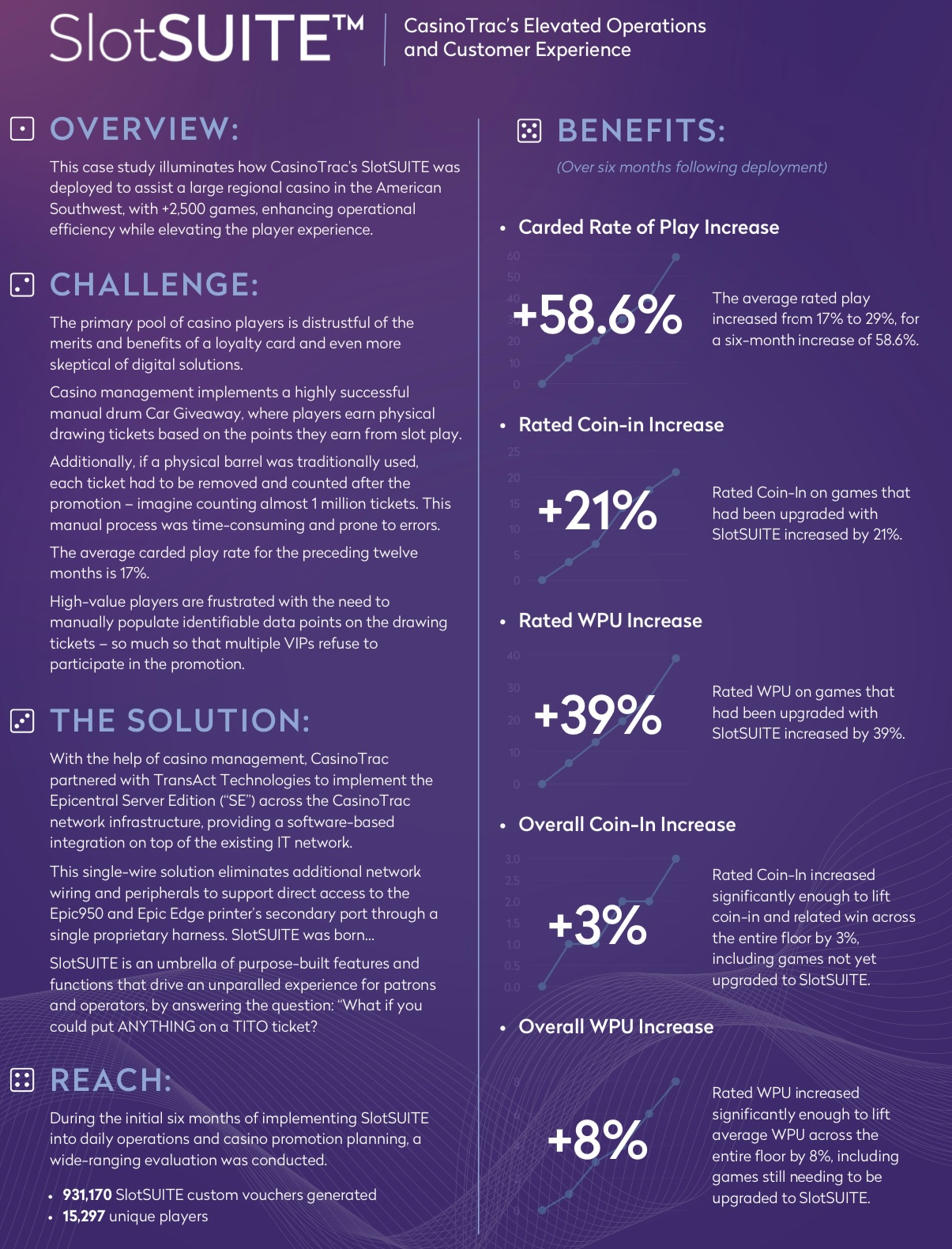

SlotSuite- SlotSUITE is designed to enhance the operations of slot machines and improve the player’s experience. One of the ways it improves players experience is their Selfpay function which allows players to get their jackpot payouts in less than a minute (typically takes over 10 minutes).

Table Trac has a case study on their website showing how SloteSUITE had helped a casino during the first 6 months of using it.

KTMobile- Mobile app where users can view their account information, view promotions, and loyalty rewards.

As a smaller company, Table Trac focuses on smaller casino operators and they’re able to customize the software to their individual clients needs.

The company offers lifetime licensing instead of a charging a monthly/annual fee and doesn’t charge for software updates which can be a big cost saver for small casinos. From what I’ve found it appears that Table Trac undercuts competitors price by about 30%.

Their systems are also Linux-based, which makes it less susceptible to cyber attacks.

“So I used to work for a small systems company before I worked for Sci Games called Table Trac, they're a publicly-traded company. They have a product called CasinoTrac. And this is a 20-person company, right? They do around $2 million a year in sales, right? I mean a very small company. But their system is top-notch. I mean it's a Linux-based system. It's easy to install. It's easy to integrate, the APIs for third-party integrations are simple, and it's just very linear. So I mean it's an easy system to run, to install, to learn. I mean, if somebody like Table Trac had the marketing prowess to actually go out there and the sales force, I mean, they could be a disruptor."

- Former Table Trac and Scientific Games Employee, Tegus Call

“No one likes to go through system changes, but when you upgrade and update with a system like CasinoTrac, you can make a true difference to your business. This CMS is tailored to our size, and CasinoTrac allows us to streamline and improve our player card system for our customers so they can use one card at all of our properties and log play time, points and rewards accordingly.”

-Tom Simmons, COO of Wild Rose Entertainment

(Table Trac) seems like a perfect fit their operations. The a la carte features, security offered through the lightweight server footprint, solid warranties, upgrades, and lifetime licensing set CasinoTrac head and shoulders above the competition.

-Management from Saddle West Hotel

The company sells these systems in United States, Australia, Japan, the Caribbean and countries in both Central and South America but the United States makes up 93% of their revenue. They’re licensed to sell in 17 states.

They’ve been growing nicely as they’ve installed at least 10 new systems each year since 2019 and currently have 5 in the backlog.

They have grown from one casino in 1995 to now having systems in over 300 casinos with 115 operators.

Financials

Table Trac breaks down their revenue in 3 segments

System Revenue - System revenue is earned from installing their CasinoTrac system, and revenue is recognized after the completion of the installation. This portion of their revenue can be quite lumpy as the sale cycle can be quite long for one of these systems. In 2024, system revenue had 70% gross margin and was 36% of the companies total revenue.

Maintence Revenue - Casinos sign a maintenance contract with Table Trac to provide support and general upkeep of the system. This is in my opinion the most important part of their revenue as it’s recurring and has 80% gross margins.

As they onboard more casinos it’ll keep on increasing their recurring revenue from maintenance. They’re getting closer to reaching an inflection point where maintenance revenue can can cover their overhead costs which would allow the gross profit from system and service to go straight to the bottom line.

Service and Other Revenues - This portion of their revenue includes DataTrac, KioskTrac, SlotSuite and license agreements. Service revenues grew 45% in 2024, mainly due to an increase in DataTrac services and SlotSUITE, both of which are recurring revenue. This is currently the smallest portion of their revenue at 15% and has the lowest gross margin at 39%.

While overall revenue growth has been inconsistent because of system sales, maintenance revenue has grown steadily (except for a small dip in 2020 because of Covid) at a 14% CAGR since 2015.

They also have a segment called Lease Revenue, which involves sales-type leasing with their hardware, but it has only been included twice in the past 10 years.

Despite the revenue growth, their net income hasn’t passed the 2021 peak of $1.71 million.

The reason for this is because they’ve almost doubled their employees since 2020 going from 24 employees to 38 employees this year. They’ve expanded their sales and marketing team, and their growth intentions are clear—just look at the press release headline TABLE TRAC INC. INITIATES AGGRESSIVE EXPANSION PLAN.

Net income in 2024 was also impacted by a one-time payment to a costumer of $275,000 as a result of one of their promotional software’s not performing to the agreed upon specifications.

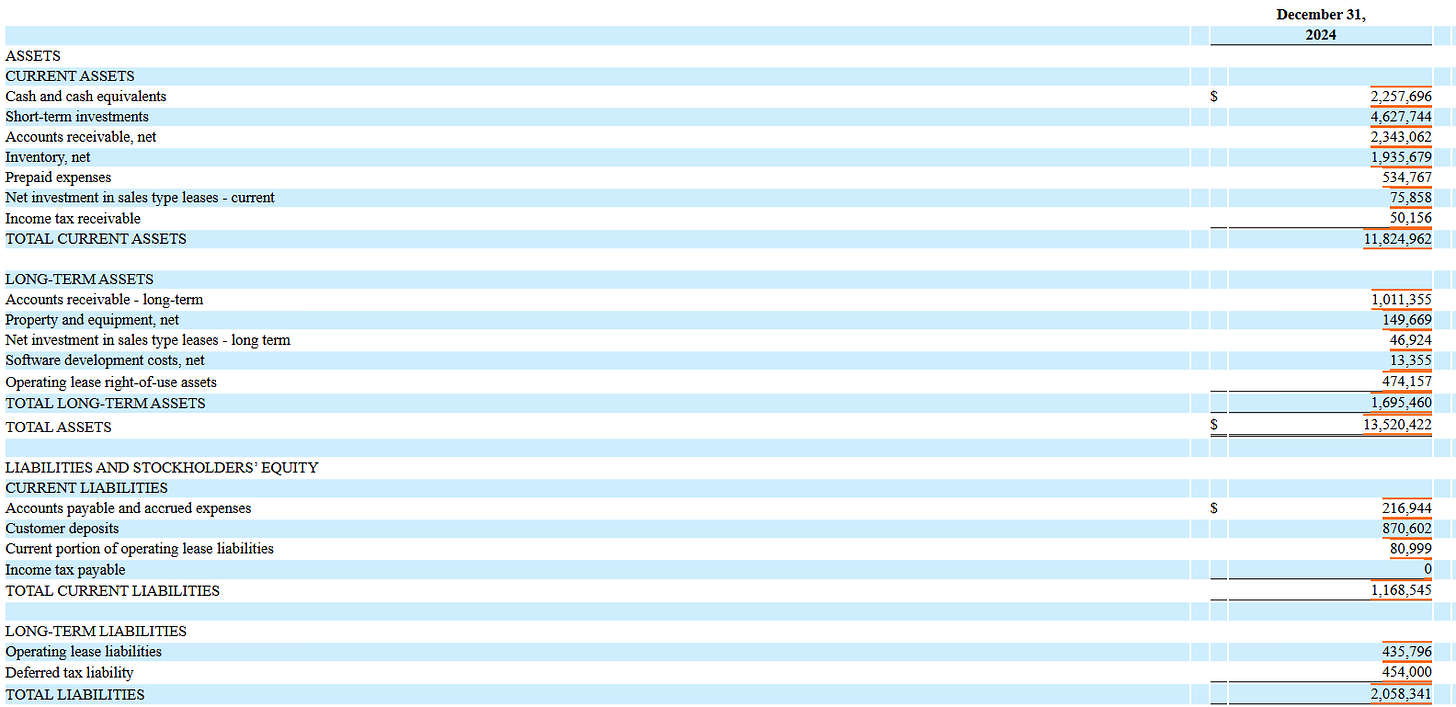

The company has an incredible balance sheet and is clearly overcapitalized as they have more cash than total liabilities.

Table Trac tends to have a very clean cash flow statement with minimal SBC and Capex though this year they had a higher Capex than usual ($129k) due to the opening of their Las Vegas office.

They started paying a small 0.7% dividend in 2022 which they can easily cover with their FCF. Table Trac did $1.89 million in FCF in 2024.

Risks

There are two main risks with Table Trac

Competition - The CMS space has a few major players—namely Light & Wonder, IGT, and Konami—who control the majority of the market.

While these companies typically focus on the bigger casinos, some of them have been designing their software systems for smaller casinos.

It’s worth noting that the big competitors don’t only sell CMS which I would say is a big advantage for Table Trac.

"There are many unique benefits to selecting CasinoTrac as your casino management system. CasinoTrac is a full-featured, fully unified CMS stack; all our support is US-based and distributed strategically near customer sites. Our unique licensing models eliminate expensive third-party costs, upgrades are free forever and finally, the biggest differentiator is that we are a technology company only - we are not a box fabricator or game designer that also sells systems. Systems, as a business, is all we do." - Jeff Baldi, SVP Commercial Strategy

CEO Retiring - Chad Hoehne created the software and is the heart and soul of the business. He’s now in his 60s, and if he retires, the company would lose its founder, who is both the CEO and CTO.

Conclusion

While Table Trac is pretty cheap it’s a little more expensive then I’d like.

It’ll stay on my watchlist and I’ll revisit it if a few things change

Change in Capital Allocation- While paying a dividend is a start, it is still very small. Holding over $4 million in CDs earning about 4.50% isn’t great compared to the value of doing buybacks.

System Revenue/Income Growth - While the company has hired new employees and increased their marketing efforts it has yet to truly pay off. Net income has stayed stagnant (though it would’ve been up about 14% if not for the $275k paid back to a customer) and system revenue hasn’t grown at a fast enough rate to make up for it. I’ll be watching to see if they make any new system sales.

Multiple Shrinks - While 11x earnings isn’t bad for a growing company, I would be a lot happier if I could buy it at a 15% owner earnings yield (they currently trade at a 12%).

My biggest concern is how quickly they can add new systems so that the maintenance revenue to cover the overhead. Investors have been talking about how this is going to happen for years but it keeps on taking longer then expected as SG&A has grown.

Other

Table Trac currently holds 4 patents on their technology.

• U.S. Patent No. 5,957,776 (original patent for the Table Trac system)

• U.S. Patent No. 10,769,885 B2 (granted September 2020)

• U.S. Patent No. 11,024,116 (granted June 2021)

• U.S. Patent No. 11,417,169 (granted August 2022)

There have been a bunch of good write-ups on Table Trac

New Substack

What is A to Z Stocks?

A to Z Stocks is a newsletter where I’ll be sharing interesting companies I come across while working my way A to Z through a stock exchange.

As I go through these exchanges, I often find companies that catch my attention but don’t necessarily warrant a full write-up. Some are great/ interesting businesses, but they might not fit the usual focus of my main Substack. This newsletter is where I’ll highlight those companies.

I posted my first write-up on there about a company growing quickly trading at just 2.5x EV/EBITDA but has some big issues (which is why I didn’t write about it here).

If you enjoy my write-ups please consider subscribing.

Thank you.

The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions

Cool find!