Ticker- CRMT

Market Cap- $380 million

Car-Mart is currently trading at about $59 a share down from a high of $156 in 2021. It’s currently trading at a massive discount to account receivables as its account receivables per share is $171 after around a 24% allowance for credit loss. Is this discount warranted, or is it a great buying opportunity?

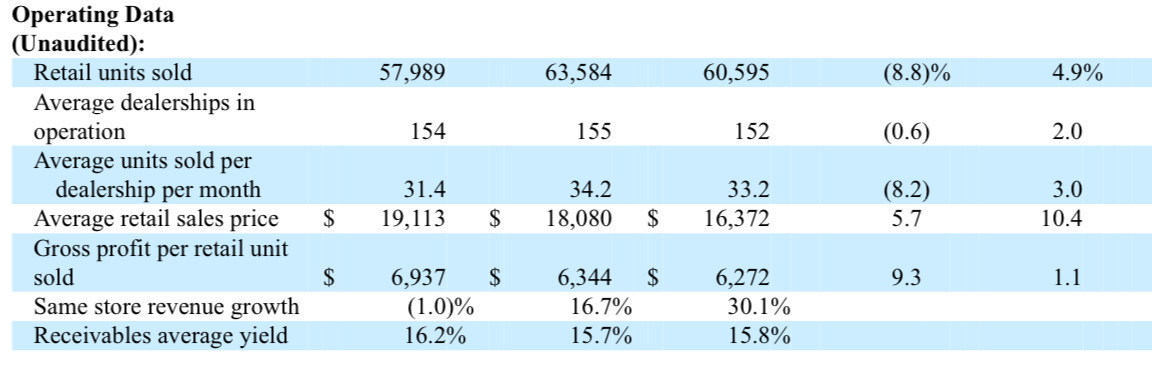

America’s Car-Mart is a “buy here pay here” car dealer that sells used cars mainly to “subprime” costumers. This means the costumers buying from them normally don’t have access to credit or have low FICO scores. The average price of a car that Car-Mart sold in 2024 was $19,113 which is up from $18,080 in 2023. Used vehicle prices were up in 2024 because of higher demand and a tight supply of used cars.

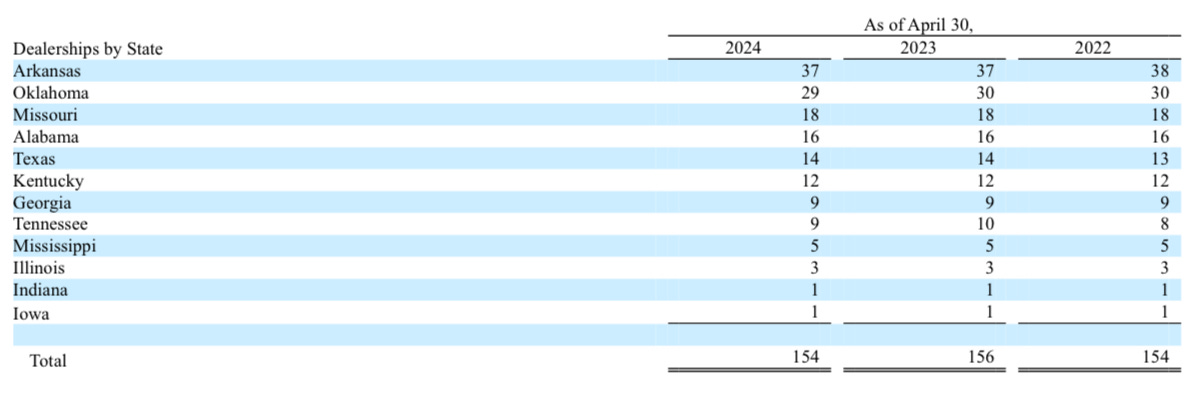

They have 154 dealerships in 12 different states which is down from 156 dealerships in 2023.

Arkansas is the companies biggest state as they have 37 dealerships there and they account for approximately 27% of the companies revenue.

Car-Mart says that they prefer to operate in smaller communities as they say it develops stronger personal relationships which helps with better collection results. Currently 71% of Car-Mart dealerships are in cities with a population of 50,000 or less.

UNDERWRITING AND FINANCING

The average down payment on a vehicle is 5.4% and the terms can range from 18 months to 69 months with an average of 47.9 months (3.9 years). The average term duration has been increasing the last few years as it was 46.3 months in 2023 and 42.9 months in 2022. This negatively affects the companies cash flow as it now takes longer to recover their investment.

The average weighted interest rate in the portfolio is 16.9%.

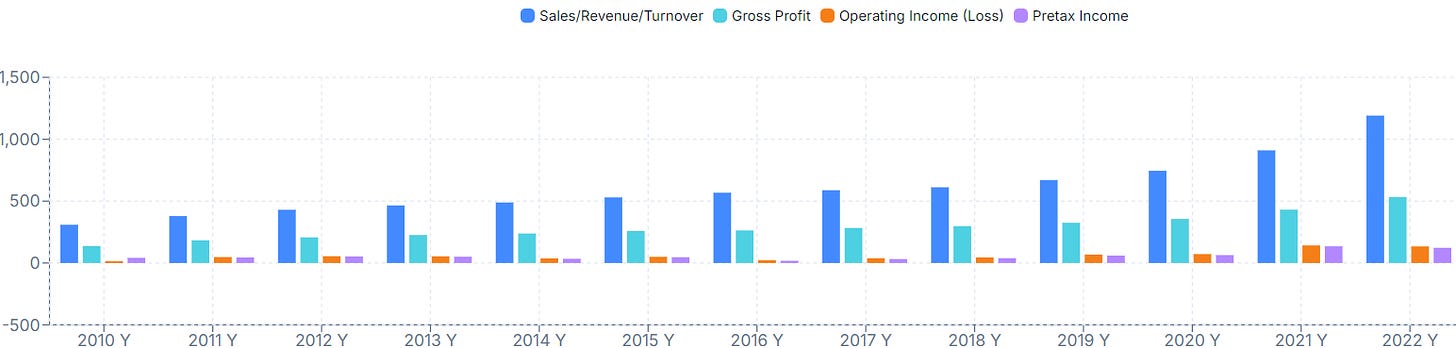

Historical financials

Looking at Car-Mart’s financial history shows a very impressive story. Just looking out at the past 10 years they’ve grown their revenue from $489 million in 2014 to $1.19 billion in 2022 and grew their EPS from $2.36 to $14.59.

A big reason for the massive growth in EPS is because Car-Mart has done quite a lot of share buybacks. In 2014 they had 9.39 million shares outstanding and in 2022 they had 6.8 million shares outstanding.

Car-Mart’s gross margin on average over the past five years was 36%. While in 2024 their gross margin was 34.7% it was actually up slightly from 33.5% in 2023, mainly because of the increase in the average price of cars sold.

Risks

You probably noticed above that I showed the data until 2022. The reason for that is because 2023 and 2024 are nowhere near as pretty. Revenue peaked in 2023 at $1.4 billion and fell slightly to $1.39 billion in 2024. Their EPS in 2022 was $3.20 and in 2024 was -$4.92.

They also sold less vehicles in 2024 than they did in 2023 or 2022. They sold 57,989 vehicles in 2024 compared to 63,584 in 2023 and 60,595 in 2022.

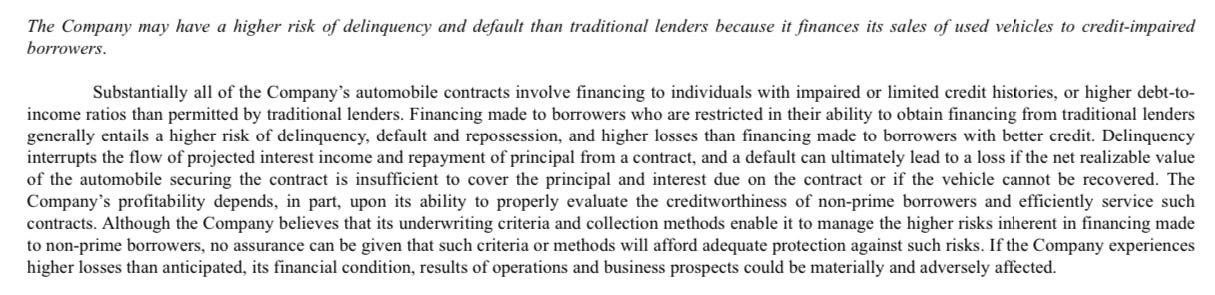

Car-Mart’s customer base has been hurt pretty bad recently as interest rates and inflation have been higher. The first risk mentioned in Car-Marts 10K pretty much sums it up perfectly how this affects the business.

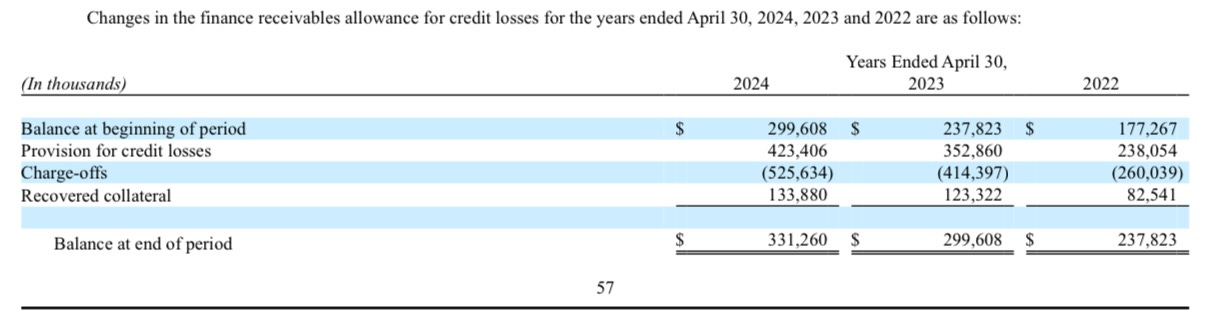

To really see how badly Car-Mart is being affected all we have to do is look at the charge-off rate. Going back to the 2008 financial crisis, charge offs were 26% in 2008, 25% in 2009, 23% in 2010, and 24% in 2011. In 2024 their charge off rate was slightly more than 27%. This is obviously horrible for Car-Mart as they had to charge off $526 million dollars in 2024 up from $414 million in 2023.

While they were able to recover over $100 million in collateral it’s still is terrible how much they had to charge off.

The single biggest factor in whether Car-Mart ends up being a good investment or not is dependent on if their loan book preforms.

One of Car-Mart’s former CEOs said “Collections is the focus of our business, selling cars is not.” That’s more important now than ever so let’s talk about collections.

Each dealership monitors its costumer accounts using the companies collections software. When an account is 1 to 3 days late Car-Mart will either call or text the customer. Car-Mart says that they try to resolve payment delinquencies before repossessing the vehicle. Sometimes this can mean modifying the contract if they believe it’ll help the customer be able to make their payments.

The average loan the company charges off is around 70 days delinquent.

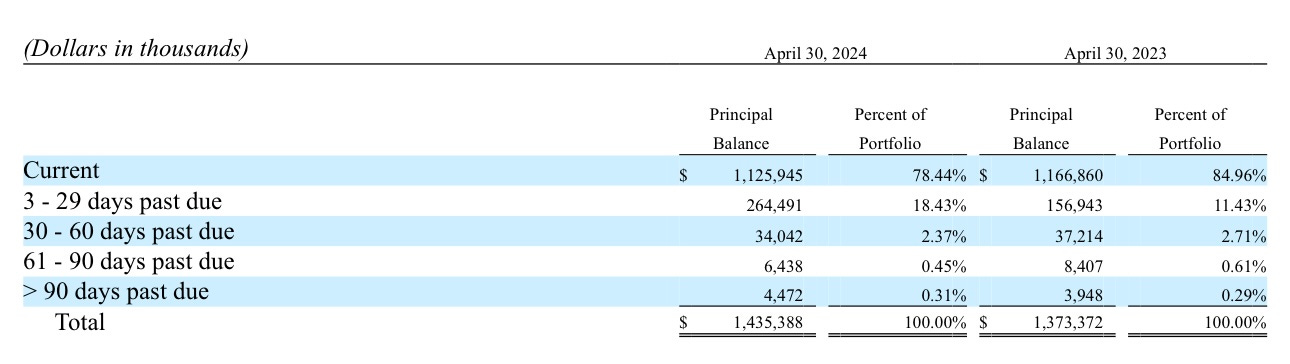

Below was the state of their loan portfolio from their latest 10K.

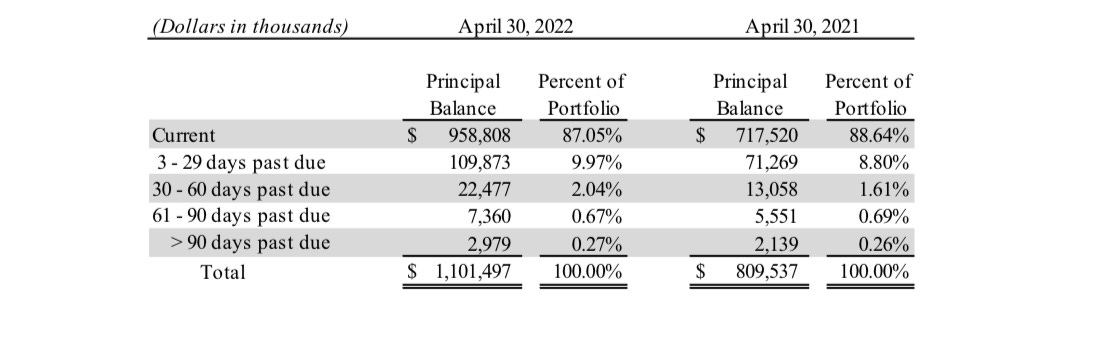

Although their portfolio doesn’t look significantly worse year over year, their 2022 10K shows how the percentage of past due loans has increased.

Debt

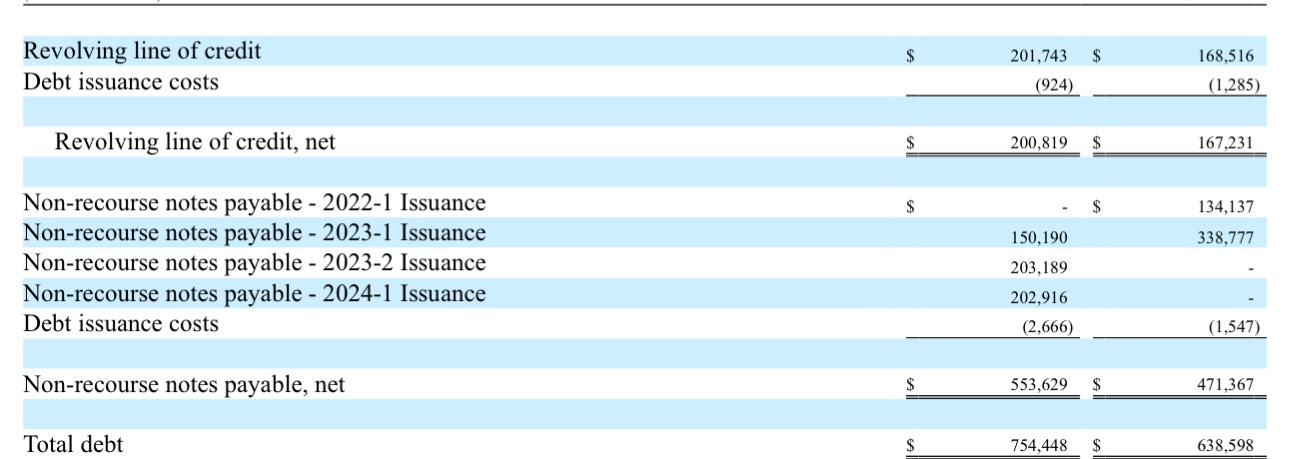

The company has issued 4 non recourse notes backed by their finance receivables but has already paid one off. The 3 other ones were initially $400 million, $360 million, and $250 million with coupon rates of 8.68%, 8.80%, and 9.50%. They’ve been paying them down and now owe $553 million in total. The maturities on these notes are in 2030 and 2031.

A more in depth analysis

If you would like to read more in-depth about the business I highly recommend you read Geoff Gannon’s write up on Car-Mart. While it was written in 2014 it does an incredible job explaining the business and it’s history. He’s also more recently talked about Car-Mart on his podcast Focused Compounding.

Conclusion

While I think Car-Mart is trading at a much bigger discount to receivables than normal I don’t think it’s in a good position as a company. With their average term length going up and their increasing charge-offs they are having quite a rough time trying to handle the current environment. That being said if they’re able to lower charge offs over the next year while interest rates are (hopefully) going down the stock should gain a lot of momentum. They’re also reporting earnings on September 4th, so hopefully we’ll see some sort of improvement in charge-offs and hear management’s thoughts on the coming months.

Something to note is that Car-Mart reacts incredibly strongly to news about interest rates as a rate cut would massively help the company.

I currently hold CRMT as a less than 1% position in my portfolio to track the stock and watch how the company performs over the coming months.

Disclaimer: Nothing from this article should be taken as financial advice. It is for educational and entertainment purposes only. Consult a financial advisor before buying or selling any securities mentioned.