NOTE- All numbers in this write up are in euros unless specified otherwise

Ticker- AIA.AT

Market Cap- €2.26 Billion

Enterprise Value- €3.04 Billion

Athens International Airport is by far the biggest airport in Greece as it accounted for 35% of the Greek aviation traffic in 2022. Despite its dominant position and great FCF production it’s trading at 10x EV/EBITDA and 7.9x P/FCF.

AIA went public in 2023 and currently 24.99% of the company is free float, 25.5% is owned by the Greek government, and slightly more than 50% is owned by AviAlliance which is a private airport management company.

Their business is split into two segments, non-air activities and air activities.

Non-Air Activities

Retail Concession Services- The airport had a total number of 155 stores, 75 of which are commercial retail stores. The concessions agreements are normally between 5 and 8 years. Concessions pay a minimum annual fee and pay a variable fee based on a percentage of their sales. This allows AIA to get consistent income while also allowing them to have a nice upside.

Parking Services- The airport has 7,350 total parking spots and they’re planning on increasing the total number of spots. Parking revenue has experienced a significant rebound since the covid. After plummeting to €5.1 million in 2020, revenues rose to €19.1 million by 2023 and continue to grow quickly reaching €10.8 million in the first half of 2024.

Non-Air activities made up 23% of the total revenue in 2023

Air Activities

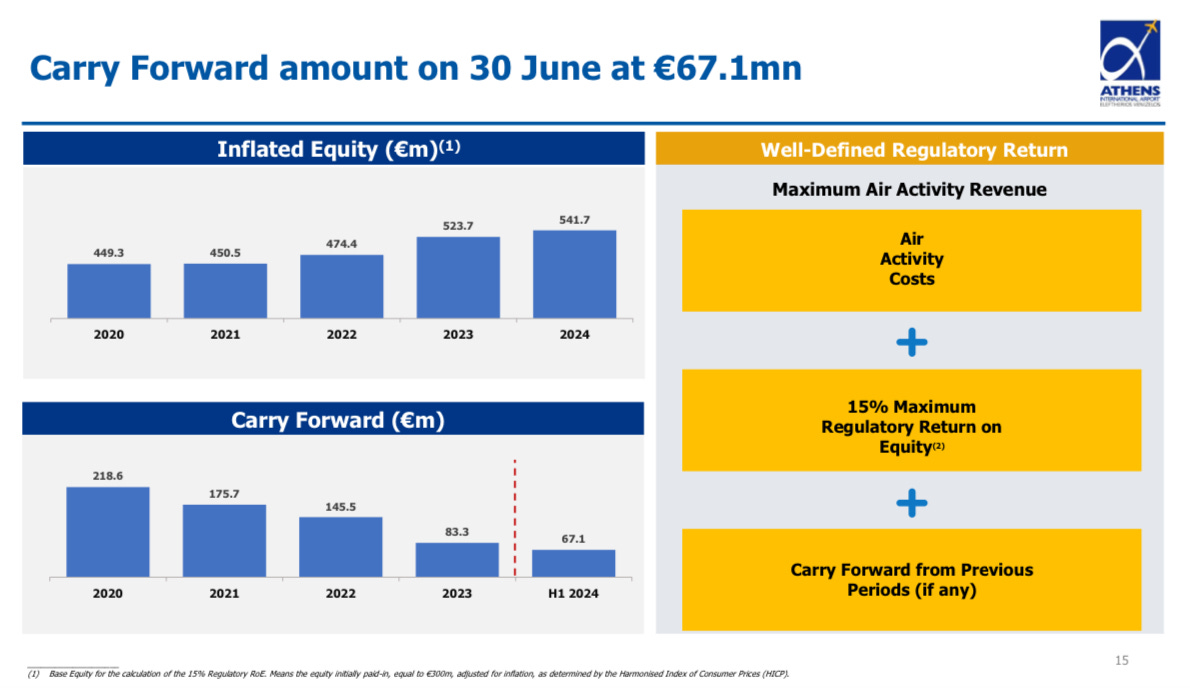

AIA charges airlines fees for landing, taxiing, air traffic control, parking, security, and other services. AIA has a government mandated cap on earnings from air activities. The cap limits them to only be able to make 15% return on equity and anything exceeding 15% goes directly to the government. AIA is currently over earning as they have carry forward from under earning during covid.

Air activities made up 77% of the revenue in 2023

Passenger Traffic

Their passenger traffic was crushed by covid, which led to only 8 million people flying in 2020. However, the numbers have been picking up since then, as in just the first half of 2024, 14 million people flew from the airport.

The 14 million passengers in H1 2024 was split 4.1 million domestic and 9.9 million international.

I wouldn't be surprised if this trend continues, as Greek tourism has been steadily growing for years now. Despite the setback from COVID in 2020, 2 million more people visited Greece in 2023 than in 2019.

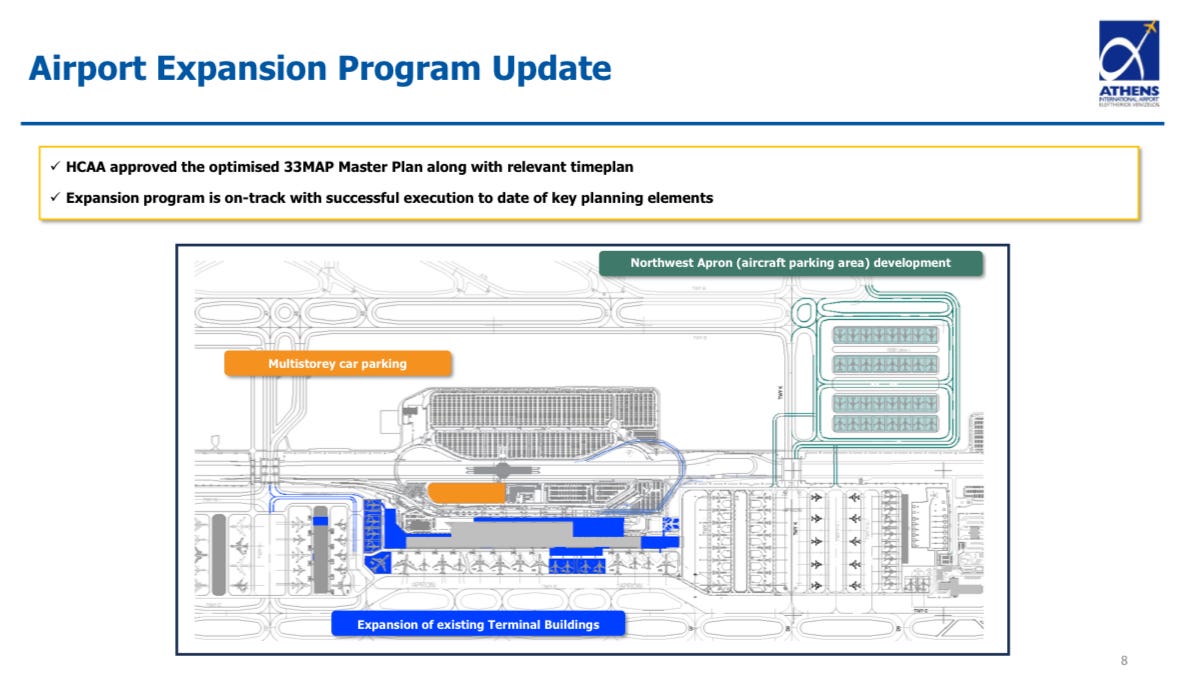

Master Plan

AIA is planning on expanding the airport to be able to accommodate 33 million people annually. This plan was created in 2019 as at one point they were at 95% capacity but the plan was delayed because of the drop of business during covid. This plan includes-

Expanding the main terminal building by approximately 81,000 square meters

Developing a new apron with space for 32 aircraft stands

Constructing a new multi-story car park

They have already taken a €128 million loan to finance the construction.

To my knowledge the construction hasn’t started yet but is meant to begin in Q1 2025 and be finished by 2028. This is the first part of the plan as they want to build up the capacity to 50 million annually by 2046.

Competition

In short, there is no competition at all which is why I got interested in this company to begin with. There are 15 international airports in Greece and the two biggest airports besides for Athens Airport are Airport of Thessaloniki and Heraklion International Airport.

Heraklion International Airport is the second-busiest airport in Greece, serving over 8 million passengers in 2023. Despite its high volume of traffic it’s incredibly old, broken down, and unmaintained. To get a sense of how poor its condition is, simply read through this Reddit post or check its 2.6-star Google Maps page with 23,000 reviews. The airport is scheduled to stop operating in 2027 and be fixed up, expanded, and renamed. The new airport will initially be have a max capacity of 9 million passengers and will eventually have a max capacity of 18 million. This airport doesn’t really matter to AIA as its on a different island.

Airport of Thessaloniki on the other hand is a much nicer airport. It has 4.6 stars on google maps with 14,000 reviews and has won awards as one of the top European airports in the 5 to 15 million passenger category. In 2023 approximately 7 million passengers flew from through the airport. While I couldn’t find a official max capacity it seems the consensus is that the airport can handle 8-10 million passengers annually.

Both airports are significantly smaller than AIA. Even if these airports combined, AIA still handled 13 million more passengers in 2023 and has a greater overall capacity.

AIA’s most significant advantage is its location. Athens is the capital of Greece, the largest city by population, and the biggest tourist destination. Most tourists visiting Greece want to go to Athens, and it wouldn’t make sense to use other airports.

Heraklion is on a different island and Thessaloniki is about a 6 hour drive from Athens. If you’re planning on going to Greece it’s a no brainer which airport you’ll choose.

Income Statement

I only have the financials from 2019 and on (if anyone knows how to get earlier financial statements please let me know) so there hasn’t been a normalized year of earnings.

Their revenue, EBITDA, and net income have all jumped back to higher than 2019 and have grown quite nicely.

Most of this “growth” is just the business going back to normal after Covid so these “growth” numbers aren’t impressive.

Despite most of the growth being a recovery from covid, it does appear that the airport is actually still growing as they are expecting low double digit growth in passengers in full year 2024 compared to 2023 and are planning on expanding the airport to accommodate this growth. If we assume a 10% growth in passengers, this would mean they expect about 30.98 million passengers in full year 2024.

Something important to note is that their EBITDA margin is likely to decrease in the coming years as they’re currently overearning on their air activities as they have €67.1 million (as of June 30) in carry forwards.

Their EBITDA margin in H1 2024 was 65% and they’re predicting that for full year 2024 their EBITDA margin will be higher than 60%.

Balance Sheet

Current Assets- 248.8 million

Total Assets- 1.937 billion

Current Liabilities- 285.9 million

Total Liabilities- 1.448 billion

Overall their balance sheet isn’t the best but it’s definitely not the worst. They have a current ratio of 0.87 which is made up of cash and 2X net debt to LTM EBITDA.

AIA has €781 million net debt, and while I normally prefer companies with much less debt, AIA is such a high quality business that I don't mind the debt as much.

They have €803 million left on their GPD bond loan which has semi annual payments and matures in 2037. The interest on this loan is linked to the 6 month Euribor + an applicable margin that was recently reduced when AIA’s credit rating was upgraded.

Cash Flow

Their cash flow from operations has been growing nicely from €185.5 million in 2019 to €319 million in LTM. Their CapEx will likely be growing over the next few years as they carry out the construction for the master plan.

AIA also currently pays a 4.38% dividend yield

Risk

The biggest risk is the cap on air activity earnings that I mentioned before. This cap only allows them to earn 15% return on air activities and any excess goes to the Greek government. AIA is currently benefiting from a carry forward, which is temporarily boosting its earnings from air activities. Once the carry forward is exhausted, AIA's earnings from air activities will decrease. This cap on earnings seems to be the main reason for the lower valuation on AIA compared to competitors.

AIA holds a concession to operate the airport which expires in 2046.

The initial concession was awarded on June 11, 1996. This concession was then renewed for a twenty-year term in 2019 which now expires on June 11, 2046. June 11, 2046, the concession will revert to the Greek state. On a more positive note, AIA has the right to match the highest bidder

There’s a fee currently of EUR 15/passenger which will be lowered to 3/passenger in November.

Valuation

Valuing AIA is uniquely challenging.

If you compare AIA to other public airports it looks like a great deal. It trades at 10.28x EV/EBITDA which is similar if not cheaper than other airports while also having substantially better margins than others. The problem is each airports circumstances are uniquely different which makes it hard to compare face to face. For example while AIA’s concession ends in 2046, other airports own their assets or have different timelines till their concession ends. For me this (along with their cap on ROE) rules out trying to use peer valuations

So instead I looked at their free cash flow.

Based on their LTM FCF, AIA is trading at a 12.6% free cash flow yield. This is a very high free cash flow yield, considering the quality of the business, but there’s also a catch. As AIA runs out of their carry forwards their EBITDA will decrease and in turn so will their FCF.

I like to be very rough when I value a company. What I mean by this is that in my valuations, I prefer to round down a company's numbers to make them appear more conservative. If the company can still pass this test, it begins to look like a very promising investment. In this case I’m going to pretend like their carry forwards don’t even exist.

Based on 2023 number AIA is earning close to a 30% return on equity from their air activities. If we were to cut their LTM net income from air activities in half and then directly remove it from their LTM FCF, AIA would be trading at a 9.02% free cash flow yield.

I think this is a very good FCF yield for a company of this quality that’s planning to nearly double its size, will continue over-earning for some time, and may potentially experience a multiple re-rating when EBITDA margins stabilize and investors feel more comfortable with its earnings.

Another point to add is that AviAlliance upped their stake in the company by the IPO by 10% at a price much higher than the share price is currently.

I currently don’t hold a position in this company but I’m keeping a close eye on it and may pull the trigger sooner than later.

Disclaimer: Nothing from this article should be taken as financial advice. It is for educational and entertainment purposes only. Consult a financial advisor before buying or selling any securities mentioned.

Thanks for sharing your thesis!

It piqued my interest so I took a closer look. Specifically at the effect of the Air revenues cap, as that seems to be the most important thing here. Now I could be completely wrong here, but from what I'm seeing it's a way bigger deal than you're making it seem.

Granted a 10% FCF yield with a 5% dividend yield is not bad, but I think it's important to look at the potential earnings growth, because that's the biggest driver for returns. The Air revenues cap has a huge impact on this. I agree on not using the carry forward (they should run out early next year anyways).

From what I gather the cap is based on their inital paid-in capital (€300M), which is adjusted for inflation annually. The max earnings from the Air segment is 15% of this inflated equity. Which would mean that the maximum earnings growth from the Air segment is in line with inflation. So let's say 3%.

Now of course the Non-Air segment is uncapped, but only accounts for <40% of earnings. So even if this segment has a 20% earnings CAGR the total CAGR would only be 11% (8% + 3%).

Now of course I don't know what kind of growth rates you're anticipating but based on plugging the above in my DCF model (4 years of forecasted growth, 15% discount rate, exit yield of 10%) the stock seems closer to overvalued than undervalued, also consdering their debt.

Would love to hear your thoughts.

Is there a chance that the new Heraklion airport leads to more traffic bypassing Athens? I imagine a lot of travel to Greece passes through Athens for connections - maybe that changes if the new Heraklion airport can accommodate bigger planes and more passenger traffic