Quick Pitch: A Capital-Light Microcap Trading at 13× Earnings With a 6.5% Dividend Yield

With a SaaS business growing at a 33% CAGR

This company is over 100 years old

Has a incredible balance sheet

Paying a 6.5% dividend on April 30th

Quick Pitch

Goodheart-Wilcox ($GWOX)

Market Cap - $181 million

Goodheart-Wilcox provides educational products specifically in the Career, Technical, and Health Education fields.

Their textbook topics range from refrigeration & air conditioning to Physiology.

They have textbooks for students from 6th-12th grade as well as for colleges and career programs.

They also provide resources for teachers for free with qualified purchases.

Revenue Breakdown

GWOX breaks down its revenue in two different ways.

They break the revenue down by 5 different categories: Middle & High Schools, Colleges, Private Career Schools, Business/Industry & Government, and an “other” category.

Middle School & High school is by far their biggest segment as it was 67% of their revenue in 2024 and Business, industry & government is their smallest making up just 4.9% of their revenue in 2024.

Revenue is also broken down between Digital revenue and Printed revenue. Printed revenue is from physical textbooks and has had pretty lumpy growth.

Digital revenue is from digital book sales and has grown rapidly at a 33% CAGR from $5.8 million in 2019 to $24.5 million in 2024.

2025

Goodheart-Wilcox has reported earnings for the first three quarters of 2025 and has performed very well so far, with revenue up 11% and EPS rising to $34.05 from $30.49.

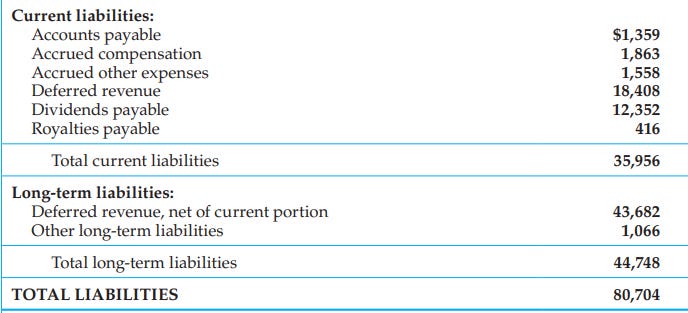

Balance Sheet

While in the quarterly reports, they don’t break down their balance sheet it’s still clearly very strong.

By January 31, Goodheart-Wilcox had $101 million in current assets and $83 million in total liabilities.

Looking at the last time they broke down their balance sheet in their 2024 annual report, $62 million out of their $80 million in liabilities was just deferred revenue.

While they don’t break down the balance sheet line by line in quarterly reports they do show the recognized and deferred revenue for each quarter and deferred revenue is up $12 million since the year end 2024.

Dividends

GWOX has been returning capital to shareholders in the form of large annual dividends. The dividends have varied but in the past few years the dividend has been over $20 per share.

I'm writing this quick pitch because $GWOX announced a $29.25 dividend for shareholders as of the April 30th close. At the current share price that’s a 6.57% dividend yield.

Conclusion

Paying less than 13× earnings for a company with a capital-light segment growing over 30% a year, an incredible balance sheet, and a 6.57% dividend yield seems like a good deal to me.

This is not an original idea from me as I originally found out about $GWOX from Smoak Capital’s 2023 letter and I know that Dirtcheapstocks has talked about it.

I know this is shorter and less detailed than usual, and I’m sorry about that—I wanted to get something out quickly before their dividend. If you’d like a full write-up on the stock, just let me know.

Disclosure - I currently own shares of Goodheart-Wilcox

The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions

Good writeup! Through which broker do you own shares of GWOX? I believe the last I checked, they weren’t available on IBKR, for example