VersaBank- A Canadian microcap Bank with 2 Catalyst

Note - All numbers are in Canadian dollars unless specified otherwise

Versabank (VBNK) is a microcap Canadian bank with a $341 million dollar market cap. In 2023 they grew EPS by 99% (helped by some share buybacks), are currently trading slightly below book, and are trying to acquire an American bank to try to start gaining more American clients for their Point of Sale business. They also own a small cyber security company which is cash flow positive. They currently have 2 potential catalyst which I think are intriguing.

Background and Business

In 1993, David Taylor (the current CEO) and a group of investors acquired Pacific & Western Trust, a small trust company with six branches and a need for capital investment, and transformed it into the world's first branchless, electronic bank with headquarters that reside in London, Ontario. David says that he got to build his bank from a whiteboard and was able to design it how he liked. He wanted his bank to take on as little risk as possible and be a cash printing machine and so far they've done just that. Since creating VersaBank they've had no material loan losses.

There are a few interesting parts of the business that I'm going to go over.

Point of Sale

Their main claim to fame is their Point of Sale financing system which they claim is state of the art and high capacity which allows it to process large numbers of small ticket loans. The credit risk is lowered for these loans by cash deposits made by the originators of the loans to pay any potential credit losses. If any loan goes over 90 days delinquent the loan goes back to the company that provided the loan. They say they haven't seen anybody else create a system like this in the US or in Canada though they do admit that competition is starting to grow.

Their point of sale loans have been growing quite quickly as they now make up 73% of their loans and have grown from C$2.22B in 2022 to C$3.08B in Q1 2024.

They see point of sales being a big growth factor for the future especially in America and in Q1 2024 their point of sales portfolio grew 7% quarter over quarter. I'll talk more about this business when talking about the US bank acquisition.

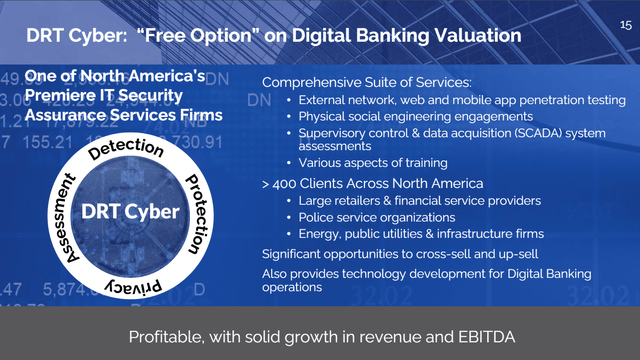

DRT Cyber

DRT Cyber is a cyber security business that David created ( DRT stands for David R Taylor) and Versabank wholly owns it. David originally created DRT to protect Versabank from hackers and decided to turn it into a company.

DRT acquired Digital Boundary Group (“DBG”) in 2020. From VBNK's press release-

"DBG provides corporate and government clients with a suite of IT security assurance services, that range from external network, web and mobile app penetration testing through to physical social engineering engagements along with supervisory control and data acquisition (SCADA) system assessments, as well as various aspects of training. DBG’s clients range from some of Canada’s largest retailers and financial service providers to Canadian and U.S. police service organizations and SCADA system reliant energy, public utilities and infrastructure firms." (DBG is profitable)

DTR combined with DBG has over 400 clients which include other banks, governments, and police departments. DTR is currently cash flow positive and is growing revenues and income by double digits. Revenue from the cybersecurity cervices component of DRTC (Digital Boundary Group, or DBG) increased 24% year over year to $2.9 million in Q1. According to the CEO, DRT is growing their cybersecurity business by 20% to 30% a year and is expected to close 2024 doing about $10 million (US) in revenue.

While I've never seen a bank that's owned a cybersecurity company it is a nice little bonus to the business. David likes to call it a free option as VersaBank trades under book value it's like your getting the cybersecurity business for free.

Commercial Lending

Their commercial loans are originated through a network of mortgage brokers and syndication partners and through direct contact with VersaBank’s clients. These loans are secured by real estate assets primarily located in Ontario. They've been winding down parts of their non-core real estate portfolio and have moved the capital to less risky investments.

By getting deposits and loans using partners, their cost of funds is brought down dramatically compared to some other banks.

They also act as a holding account for some major insolvency firms in Canada. Insolvencies are becoming more and more of a problem in Canada which is beneficial for VersaBank as they'll receive more deposits as more companies become insolvent. These deposits are also very low cost or even zero cost for VersaBank which allows them to generate better returns.

Financials

To show how fast they have been growing recently below is a table with the past 3 years revenue, income, assets, and liabilities.

Their EPS slightly declined in 2022 because of transitory strategic investments, which cost $5.2 million and $1.1 million in elevated taxes. Besides for that you can see incredible growth in every category. Revenue doubled, net income doubled, and EPS almost doubled. Their total assets have also been growing at a faster rate then their total liabilities.

As mentioned in the first paragraph VBNK did quite a lot of share buybacks this year which helped their EPS grow 99%. By the time of their 2022 10K they had 27,245,782 common shares outstanding. By the 2023 10K they were down to 25,964,424 shares outstanding which means they repurchased 1.28 million shares for a total of about 4.7% of the total market cap. They did this while VBNK was trading at a P/B of less than one which shows the management understands when to properly deploy share buybacks. David said at the most recent annual meeting "if the stock is trading below book we're buying it back".

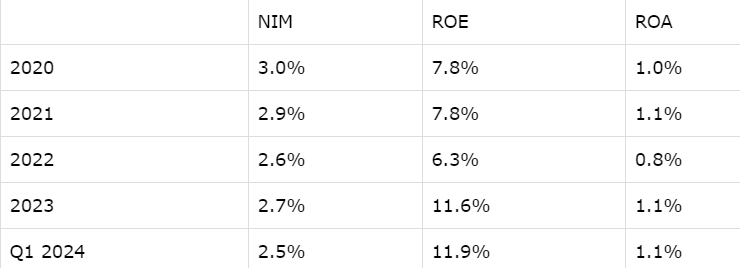

Their net interest margin (labeled as NIM in the table below) has actually decreased during this period while their ROE and their ROA have gone up.

They explained their NIM going down because they've been investing more heavily into low risk investments, which have lower margins but are safer.

"The other item I would note is some ongoing softness in our net interest margin. This is a natural outcome of the growth of the point of sale portfolio, which has lower margins but higher risk weighted returns than our real estate portfolio."- David Taylor during the Q1 2024 earnings call.

Their ROE has exploded recently having gone from 6.3% in 2022 to 11.6% in 2023. They're expecting their ROE to keep on increasing as they're guiding for Return on Common Equity to continue to increase as they grow their assets.

"The ROE will increase fairly dramatically, we’re shooting for about 16.5% once we get to the $5 billion milestone." - David Taylor Q1 earnings call

With the way their system works the more assets they have the lower their efficiency ratio gets (which is good for a bank) and the higher their Return on Common Equity gets.

They also have a small dividend yield at 0.75% which is quite tiny for a bank but I'm quite happy about it. They specifically pay a lower dividend as they're trying to continue growing the business at a quick pace.

Catalyst

VersaBank currently has 2 different catalyst though one may be reliant on the other one

1- US Bank Acquisition

On June 23, 2022 VersaBank announced that they were acquiring Minnesota based Stearns Bank Holdingford for an estimated (US)$13.5 million. Stearns bank is expected to add (US) $60 million in total assets.

While size wise it's not a massive acquisition it's much more important for a different reason, access to a US banking license. As mentioned before their claim to fame is their POS financing system and American businesses want it. David mentioned on the Q1 earnings call the demand for their system in the US market.

" I must have met at least a dozen ideally suited partners that, some are actually very familiar with our operations in Canada and are keenly interested. So in Canada, we still got some room to grow with partnerships. And, in United States, we have a tremendous opportunity. "

And

" We are working on some new, partnerships that actually are in the States, they’re so sort of keen, that despite us not yet having the U.S. license, we’re sort of cobbling together a Canadian solution for them, even despite them operating in the States. "

So even without a US banking license they are trying to work with the US companies. They are doing this through a company they made called Versa Finance. They expect it to ramp up massively when the acquisition is approved as it's more affective and they'll add new costumers. Also the interest margins are higher in America so VersaBank's NIM should increase slightly as a result.

2- Sale of Cybersecurity Business

As mentioned before the market isn't adding in the value of the cybersecurity business but it will if VersaBank sells it. This isn't me trying to do a some of the parts analysis that may never play out. it's straight out of the CEO's mouth. "it's quite likely we'll divest DRT after (acquisition) approval". He mentions that owning the business doesn't work with US regulators so it'll have to be sold or spun off.

He says that people have valued it as high as a $100 million which I don't think is a stretch at all. DRT is expected to do (US) $10 million in revenue in 2024 and is already cash flow positive so for it to sell for 10x revenue actually sounds quite cheap as most cybersecurity companies trade at way higher valuations. Also DRT's clients are quite high quality being governments, banks, and police stations which means just the client list alone adds a lot of value.

What if the Acquisition doesn't go Through?

The acquisition was announced in 2022 and VersaBank has been waiting for it to be approved for quite a while now. They think it's taking a long time as there have been some big bank failures in the US in the past couple years and the regulators are cautious of this new system. David has said multiple times that he has answered all the questions regulators have asked him and will answer any questions they have for him. They are still incredibly confident that the acquisition will go through and are doing all they can to try to make it happen in the first half of 2024. Just in case the acquisition doesn't go through they made a back up plane.

They will use their finance company (Versa Finance) which is in America to work with other US banks to use their system. They said they might work with US banks even if the acquisition does go through to keep up with the growth.

They would also start paying a bigger dividend if the acquisition doesn't get approved as they've been saving earnings to continue growing. If they don't need to save money to continue growing they'll put money towards a bigger dividend which can attract more investors.

This is obviously not a full analysis but I wanted to share my thoughts on what appears to be a fast growing bank trading at a cheap valuation. I would highly recommend anybody who's interested to do their own due diligence and let me know what they think. The CEO has done a bunch of presentations like this one that give a brief overview on his thoughts on the banks future which I recommend any potential investors to watch. I haven't given my valuation of VBNK in the analysis as I don't feel like I can properly value it as it's a bank. Despite that I think it should at least be trading at book value which would be CAD 14.46 and it's currently trading at CAD 13.13.

They have their next earnings on June 5 and are doing a participating in a microcap event on June 6

This is not financial advice please do your own do due diligence before investing

Great analysis! I really think this is a uniquely great opportunity.