Business Overview and Investment Thesis

I am currently bullish on VICI as they have continued increasing the size and diversity of their portfolio while still sticking to high quality tenants and properties. Despite this they are trading at a lower P/AFFO then they have historically. They are heavily concentrated in Las Vegas which I think should be a contributing factor for VICI's future growth as tourism has been on the rebound since covid. They have some of the most popular and recognizable properties in their area of expertise (casinos) which include Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas. They have also gained popularity in the dividend investing space as they have a 5.56% dividend yield and have grown their dividend at a 7.6% CAGR while targeting a 75% AFFO payout ratio.

VICI Properties is a real estate investment trust (REIT) specializing in casinos and entertainment destinations. Created from Caesars Entertainment's reorganization, they own a massive high quality portfolio of 93 gaming, hospitality, and entertainment properties across the US and Canada. This includes iconic names like Caesars Palace, MGM Grand, and the Venetian. Their lease structures are triple-net leases which requires the tenant to pay insurance, property taxes, and maintenance taxes on the property. This lowers VICI's financial risk and creates a more consistent rental income stream.

High Quality Properties in Great Locations

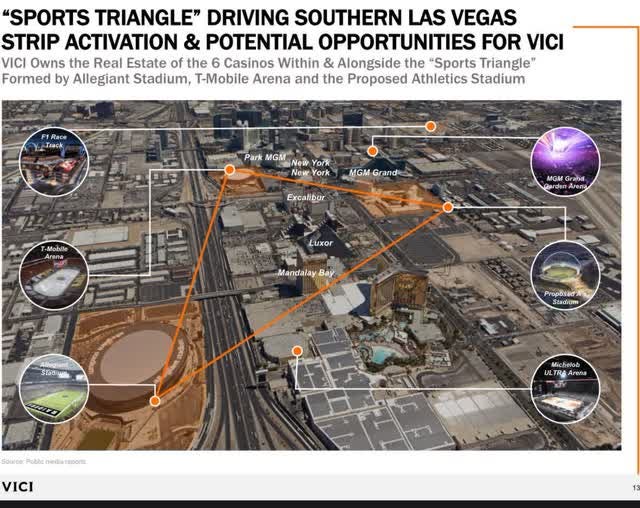

VICI focuses on having high quality properties that are in great locations. Of their casino portfolio 53% are regional 46% are in Las Vegas and 1% is international (Canada). They currently have 10 properties on the Las Vegas strip and 33 acres of empty land next to the strip. They have what they call a "sports triangle" which is 6 of their casinos are in a triangle formed by Allegiant Stadium, T-Mobile Arena and the Proposed Athletics Stadium.

The health of tourism and population growth in Las Vegas is incredibly important to VICI as 46% of their casino portfolio is on the Las Vegas Strip. I think tourism in Las Vegas should continue to grow for the foreseeable future because of a couple factors. The first is how many new attractions and sport teams have been moving to Las Vegas recently. The Golden Knights were created in 2017, the Raiders moved there in 2022, and the Oakland Athletics are planning on playing in Las Vegas by 2028. This shows that investors believe in Las Vegas to continue growing. Las Vegas has also been rebounding back from covid and is almost back to pre-covid levels. According to tourismanalytics.com in 2020 only 19.03 million tourists visited Las Vegas compared to 42.2 million tourists in 2019. While Las Vegas tourism hasn't recovered to 2019 levels yet it has been getting closer. In 2022 Las Vegas saw 38.8 million tourist which then jumped to 40.8 million tourists in 2023 for a 5.2% growth year over the year. I'm predicting that this positive growth will continue as more sport teams and attractions come to Las Vegas.

Another very important aspect when researching a REIT is looking at how healthy the companies tenants are and how diversified they are. With VICI it's incredibly important as 84% of their rent comes from their top 3 tenants.

I normally don't like when only a couple of tenants make up the majority of a companies portfolio but with VICI I don't mind as much. Their top 3 tenants are Caesars Entertainment, MGM Resorts, and The Venetian, which have a total of 32 properties between the 3 companies. These companies are established names in the gambling and hospitality industry and have long track records of profitability. All 3 of them have more assets than liabilities and they all have more than 1 billion dollars in cash or cash equivalents. The table below shows all of these 3 companies total assets, total liabilities, long term debt, and cash and cash equivalents as of the TTM.

Another great way to show how great VICI's tenants are is by looking at how incredible VICI's rent collection has been since they went public. VICI has has 100% rent collection since they went public in 2017 which is amazing. What makes this even more impressive is that they were able to do this through covid. Covid really hurt casinos and hotels as the average hotel room occupancy in 2019 for Las Vegas was 88.9% which fell to 42.1% in 2020 and was as low as 1.7% in April.

Despite this massive downturn in hotel occupancy VICI still managed to collect 100% of their rent during the pandemic which shows how high quality their tenants are.

Financials

VICI's financials have continued to compound at an incredibly fast pace since going public. Their revenue has grown from $900 million in 2018 to $3.6 billion in 2023, which is a 32% CAGR. Net income actually grew slightly faster, from $500 million in 2018 to $2.5 billion in 2023, for a 37% CAGR. While those are great numbers, the most important metric for a REIT is its AFFO per share. VICI's AFFO per share has increased every year so far, growing from $1.43 in 2018 to $2.15 in 2023 at an 8.5% CAGR. They're guiding for between $ $2.22 and $2.25 in AFFO per share in 2024 which would be 3.26% growth on the low end and 4.65% on the high end.

Dividend

As VICI is a REIT they are required to pay out at least 90% of their taxable income as a dividend. They currently have a 5.56% dividend yield and have been growing their dividend at a 7.6% CAGR. A common way to check if a REITs dividend is safe is by looking at their AFFO payout ratio. VICI currently has a 74% AFFO payout ratio which is quite good as they aim to have a 75% AFFO payout. VICI also has 2024 guidance of a 3-4% increase in AFFO and are planning on continuing growing it. With this AFFO growth and VICI's plan to target a 75% AFFO payout ratio they should hopefully be able to continue increasing their dividend for the foreseeable future.

Q4 Earnings

In their most recent earnings in Q4 VICI reported $931.87 million in revenue for the quarter ended December 2023, which is a year-over-year increase of 21%. They also reported a AFFO increase of 17.0% year-over-year to $570.4 million and, on a per share basis, increased 8.8% year-over-year to $0.55 compared to $0.51 from the quarter ended December 31, 2022. Their full year 2023 AFFO per share was $2.15 an increase of 11.8% compared to $1.93 for the full-year 2022.

On the fourth quarter earnings call Edward Pitoniak (CEO of VICI) reiterated how happy he is with VICI's Las Vegas portfolio "I strongly believe VICI's investment in Las Vegas is one of the most compelling investments in the current global commercial real estate investing landscape". Though it was John Payne VICI's COO and President who I thought had the most important lines on the call.

"there are some sectors that we don’t talk about that we’ve kind of checked off the list that says this is not right for our capital at this time. But we shouldn’t confuse that the casino business continues to be real focus of our company and one that we are just can’t be more proud of the operators and what they’ve done in ‘23 and what we see in ‘24.

While this line may not seem particularly important, I believe it holds significant value for VICI shareholders. It demonstrates that, even as the company diversifies (as will be discussed in the next section), they know what their core business is and that it's what they are best at. This will hopefully mean that they will stick with what they understand and not venture off into risky but attractive new ventures.

Growth and Diversification in 2023

VICI has recently been diversifying their portfolio into different kinds of entertainment venues and new tenants.

Announced the acquisition of 38 bowling entertainment centers in a $432.9 million sale leaseback transaction with Bowlero

VICI acquired 38 bowling centers from Bowlero (BOWL) in a sale leaseback agreement for $432.9 million. The deal comes with a 7.3% cap rate and an initial term of 25 years, with six 5-year tenant renewal options. The rent under the lease is also CPI protected and the rent will escalate if CPI is greater 2.0% with a 2.5% ceiling.

VICI pledged up to $150 million in a preferred equity investment for Canyon Ranch. This 10-year investment can be bought back by Canyon Ranch, but there's an redemption premium if they do so within the first three years.

VICI announced the acquisition of the leasehold interest of Chelsea Piers in New York City for a total purchase price of $342.9 million. This triple net lease agreement has a 32 year initial lease with a 10 year extension option.

VICI announced an agreement to provide an up to $212.2 million mezzanine loan to Kalahari to help fund the development of an indoor waterpark resort in Thornburg, Virginia. The loan has an initial term of 4 years and is VICI's first investment into a waterpark resort.

Valuation

NOTE- At the time of writing VICI was trading at $29.15

VICI is currently down 5.90% this year but it's not the only REIT that's down over the past year as interest rates have been higher the past year a lot investors have left REITs in return for safer high dividend yields like bonds. I think as the fed lowers interest rates investors will come back to the REIT sector for the high dividend yield.

I valued VICI using two methods: first by comparing it to its historical P/AFFO to it's current P/AFFO and second using a dividend discount model.

If VICI would return to it's historical P/AFFO it would trade at $ 31.26 which would mean VICI is trading at a 7.24% discount to it's historical P/AFFO. I think this is very likely to happen as the fed is planning on lowering interest rates 3 times this year.

Using a Dividend Discount Model with a 4.5% growth rate and a 9% rate of required return we end up with a share price of $ 35.56.

If you average out the estimated price between the historical P/AFFO and the dividend discount model you get a share price of $ 33.41 which would mean VICI is trading at a 14.65% discount.

Risk

High interest rates would make financing new acquisitions and deals more expensive for them which could mean less growth.

VICI is heavily concentrated in a couple of tenants and if one of their top 3 tenants isn't able to pay rent it would majorly affect VICI's AFFO. Though I don't think this is a current issue as their biggest tenants have plenty of cash.

VICI is heavily weighted in Las Vegas and if Las Vegas tourist rate numbers go down it can hurt their properties values and make it harder for some of their tenants to pay their rent.

They currently have 15.68 billion dollars of long term debt which is quite a lot but I don't think this should be an issue as long as their cash flow stays as high as it is.

Just one correction: REITs are required to pay out 90% of taxable income not “profits “