Disclaimer: Nothing from this article should be taken as financial advice. It is for educational and entertainment purposes only. Consult a financial advisor before buying or selling any securities mentioned.

Company Name- Citizens Bancshares Corporation

Ticker - $CZBS

Market Cap- $90 million

CZBS is an over capitalized minority-owned bank based in Atlanta, Georgia. In 2022, they received a $95 million in funds from the government as a part of ECIP (Emergency Capital Investment Program. These funds are in the form of preferred stock and have some very favorable terms.

It’s perpetual

It’s non cumulative

The interest rate is 0% for the first 2 years then for years 3-10, the rate will be between 0.5% and 2.0% based on how it is used (how much it’s able to increase lending to minority groups).

Since receiving the funds they’ve bought back over 10% of their total shares outstanding and have paid over $3 million in dividends. The ECIP preferred and the share buy backs have allowed BZCS to grow their EPS at a rapid pace.

2021 2022 2023 Q1 2024 Q2 2024

$1.97 $4.64 $6.27 $2.01 $2.18

The bank (as of 6/30) had over $95 million in cash, is trading at a TTM P/E of 6.8, and has a P/B of 1.15.

While a P/B of 1.15 doesn’t sound exciting for a bank, the reason it looks more expensive is because this isn’t accounting for how favorable the preferred stock terms are. While it is a liability I don’t think you should value it at 100 cents on the dollar considering it’s amazing terms.

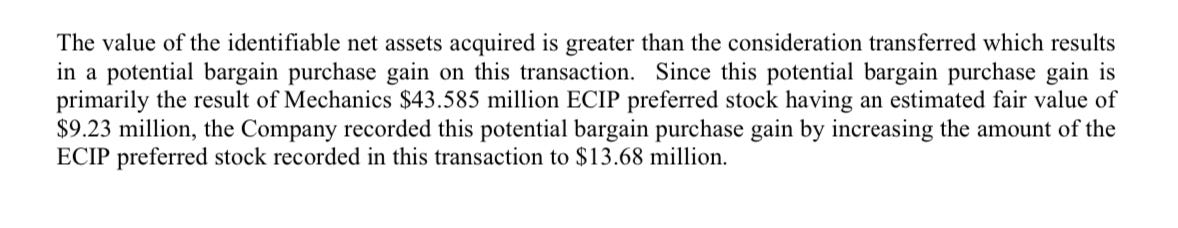

For example a ECIP bank bought another ECIP bank and gave a fair value estimate valuing it at 21 cents on the dollar.

There’s a incredible write up on CZBS from pat110 on VIC if your interested in learning more about this company. This write up is initially what got me interested in the company a few months back and is one of the most comprehensive write up I’ve ever read on VIC.

Hedge fund manager Tim Erikson has wrote about CZBS in his partner letter and has pitched it at a micro cap summit. He does a great job laying out his investment thesis for CZBS and he also has a google spreadsheet with all the banks that received ECIP funds that he posts on his twitter.

Something to note about this stock is that a lot of websites have wrong information about it. For example Yahoo Finance thinks CZBS market cap is $95 million but if you go to OTC markets and check the daily total shares outstanding times the share price you can clearly see that they have the wrong information.

Citizens Bancshare Investor Relations

Company Name- Peakstone Realty Trust

Ticker- PKST

Market Cap- $547 Million

Peakstone is a REIT that went public in 2022 and has a high exposure to office which has help beat down the share price. They own 16.6 million square feet of office and industrial real estate with a 96% occupancy rate and have a average lease term of 6.6 years. They have 66 properties in 22 different states and have some high high quality tenants like Amazon, AT&T, and 3M.

Dave Waters, founder of Alluvial capital wrote a great write up on PKST explaining why he thinks PKST is undervalued. In his article he says he estimates PKST fair value of $25.85 compared to the current share price of $15.04.

Company Name- Frontera Energy Corporation

Ticker- FEC.TO

Current Share Price- $8.61

(All numbers for this stock are in CAD not USD unless specified)

FEC announced a odd-lot tender for up to 3,375,000 shares at a maximum purchase price of $30 million (US) and a per-share purchase price of CAD$12.00. This offer is available until October 17 and is available to those who own 99 shares or less.

What makes this offer so interesting is the massive gap between the current share price and the share price at which they are buying back the shares. If you were to buy 99 shares at the current share price (CAD$8.61), it would cost CAD$852.39. If your shares were repurchased in the odd-lot tender, you would make CAD$335.61, which is a 39% return in less than a month!

The obvious risk with this is that the tender can be canceled by the company but a potential 39% gain in a month is quite enticing.

Here's a link to the companies' filing.

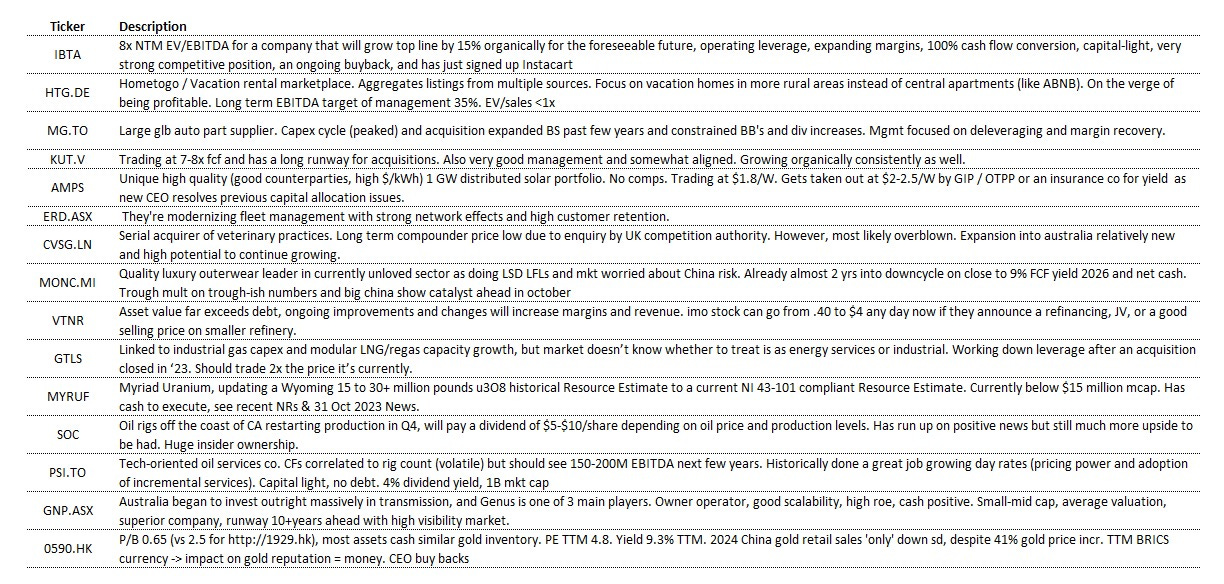

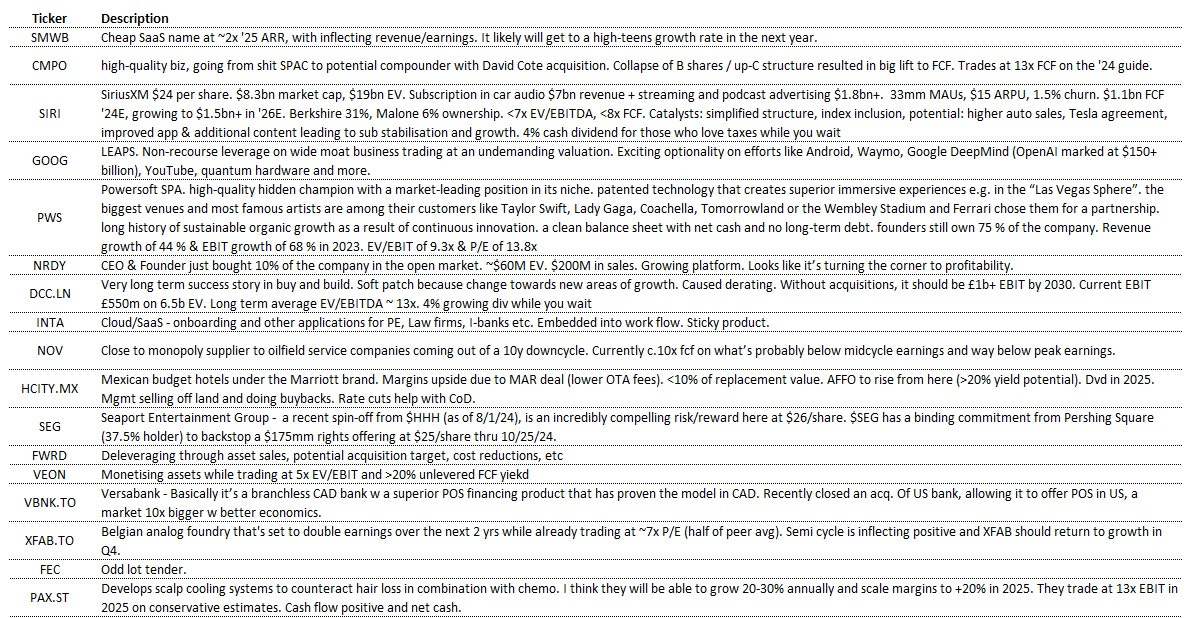

recently asked on twitter for people’s favorite current ideas and a short explanation on why they like the opportunity. Below is a page that created that has a brief overview of each idea.

CZBS looks to be trading at a P/B of 2 right now?

Hi, will you elaborate on your numbers for you price/bv calculation? Using the 2023 annual report at https://ctbconnect.com/investor-corporate-governance-information/ I can't get to 1.15 P/B no matter how I do it.