All numbers in this write-up are in British Pounds unless specified otherwise

Company Name - Kinovo ($KINO.L)

Market Cap - £39.83 million

Enterprise Value - £42.2 million

Kinovo is a UK-based provider of mechanical, electrical, and building services. They operate through 3 subsidiaries: Purdy, Dunhams, and Spokemead.

While they don’t break down the financials between the subsidiaries they do break it down between regulation, regeneration, and renewables.

Regulation- This includes safety and regulatory compliance tests that are required by law. This includes checks for electric, gas, fire, and ventilation systems. In H1 2025 regulation accounted for 57% of their total revenue.

Regeneration- This segment covers home and community improvement projects including adding CCTV, data installation, and reusing/improving vacant buildings. Regeneration accounted for 33% of their revenue in H1 2025.

Renewables- This segment focuses on energy efficient solutions by helping clients reach their net zero goals. They do insulation, energy efficient lighting, and EV charger installations. Renewables accounted for 10% of their revenue, down from the year before, mainly due to an exit from a private sector client. However, they expect an uplift in decarbonisation workstreams in H2.

Electrical services is the biggest portion of revenue as it accounted for 63% of the revenue in H1 2025.

Almost all of Kinovo’s revenue is recurring as they normally sign 3-5 year contracts with clients such as housing associations and local councils.

They announced in their half year 2025 report that 99% of their 3 year visible revenue is recurring and has increased to £175.2 million from £157 million in h1 2024.

CEO

Kinovo’s CEO is David Bullen who was brought in 2019 to help turn around the business as the business hadn’t been performing well after signing a few unprofitable deals.

David is a great CEO who was formerly the CEO at Anpario plc ($ANP.L) from 2011-2016. During that time the share price went up 4x as revenue grew by 50%, operating income doubled, and made a acquisition of a company for 5x EBITDA.

He owns 2.25% of the company.

Discontinued Operations

Kinovo had a subsidiary called DCB, a construction business the company acquired in 2016. In 2021 DCB had done £21 million in sales but just £1 million in EBITDA. They sold this subsidiary to MCG Global in 2022 for £5 million as they wanted to focus on their core high margin businesses.

As part of the deal, Kinovo agreed to provide working capital for DCB's nine remaining projects, which has been a significant drag on the business's financials.

While it has been a significant drag on the business—and not well communicated, I might add—the projects are essentially complete. They have settled to pay £2.2 million for the final project, of which they have already paid £860,000.

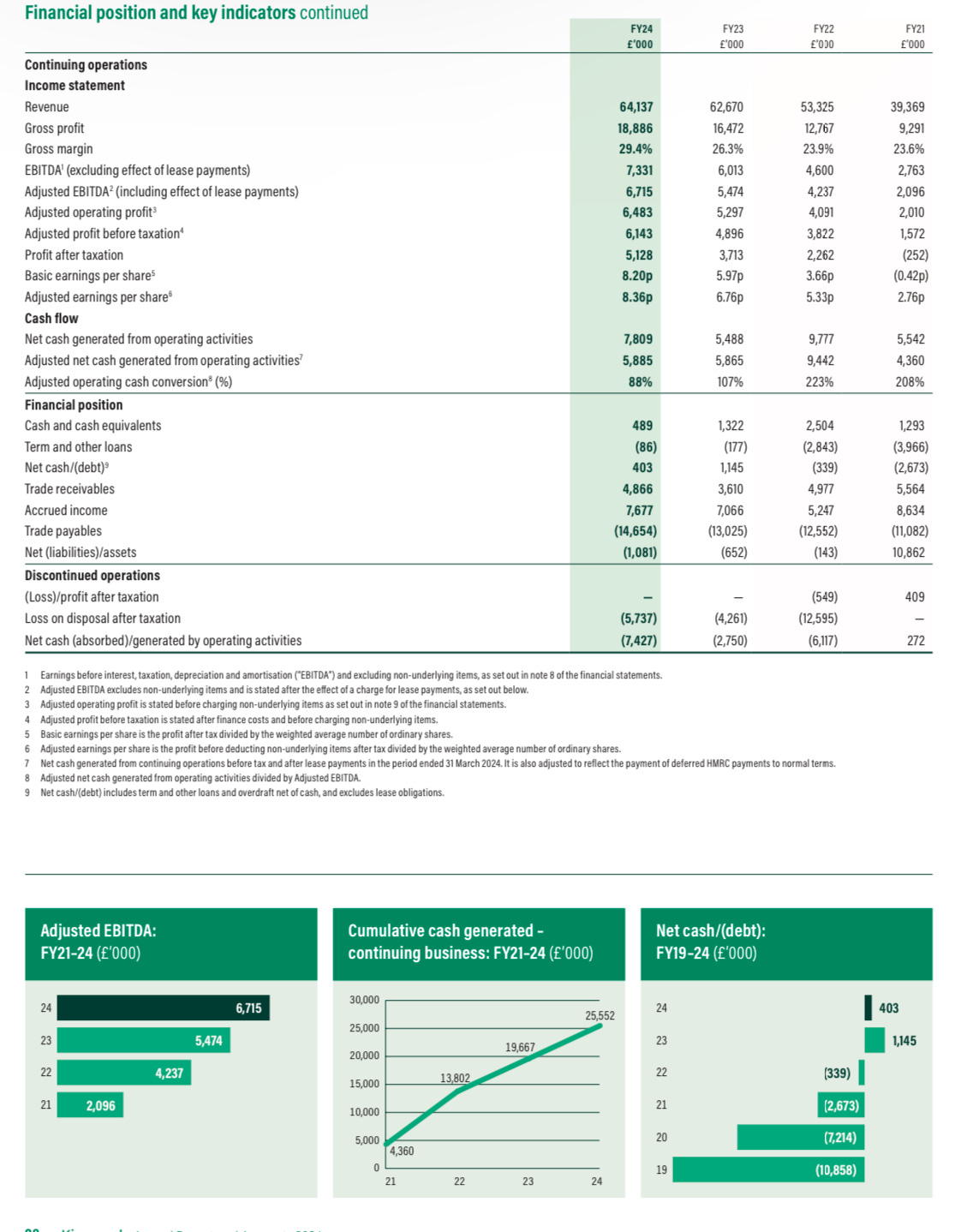

Despite the setback from DCB the core business is performing very well as gross margins have improved every year going from 23.9% in 2022 to 30.9% in h1 2025 with revenue growing as well from £53 million to £63 million LTM.

The middle graph on the bottom of the image shows just how well the core business has been performing. Since 2021 the core business has generated £25.5 million which is more than half the companies market cap.

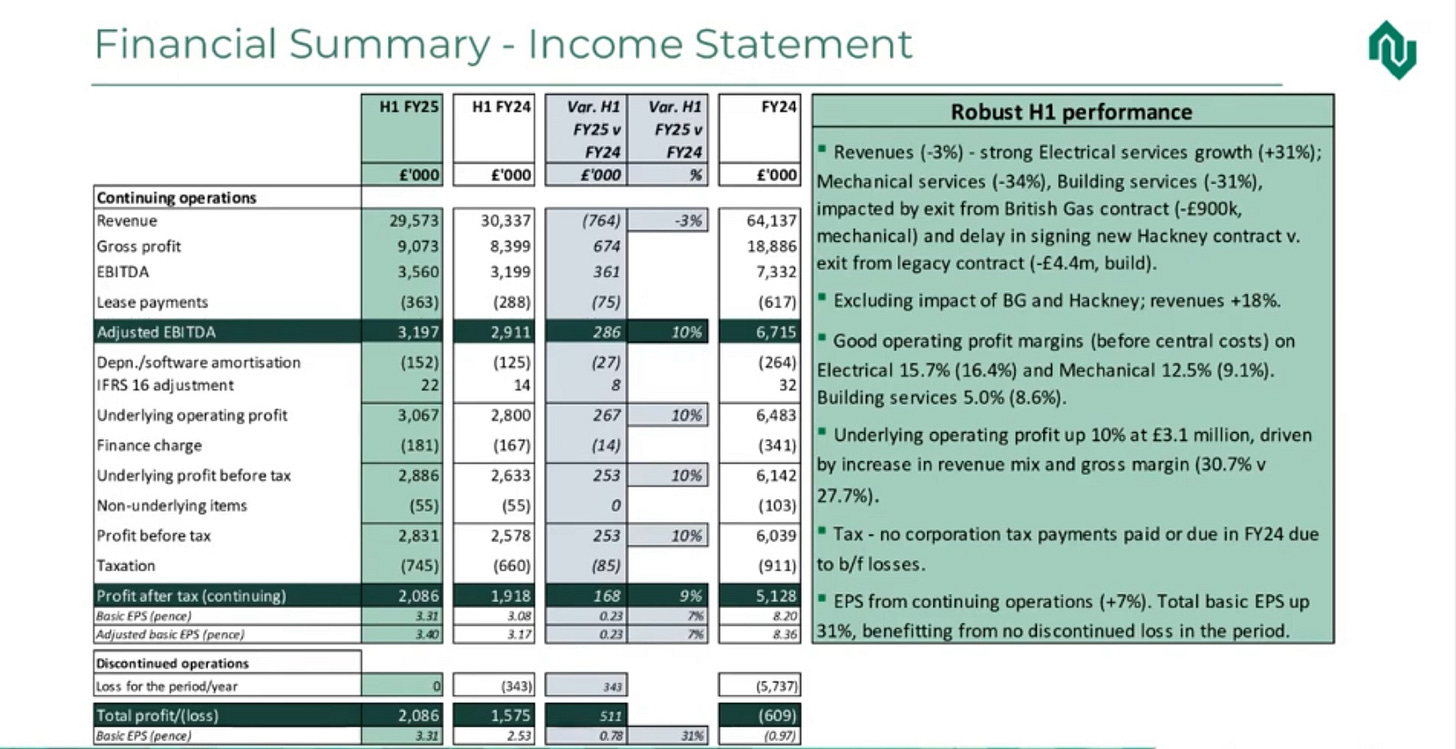

H1 2025

In H1 2025 (ended on September 30), Kinovo reported revenue of £29.6 million, which was a 3% decline compared to H1 2024, primarily because of a delay in their contract with Hackney. Despite the dip in revenue, the company achieved an 8% increase in gross profit to £9.1 million, driven by improved gross margins of 30.7%. Adjusted EBITDA rose by 10% year-over-year to £3.2 million. Kinovo said the reason for the higher gross margin was because of a favorable shift toward higher-margin electrical services.

Though most importantly like mentioned above their 3 year visible revenue has grown to £175.2 million from £157 million in h1 2024.

Growth

Regulatory - As regulatory requirements grow stricter, Kinovo is able to benefit from rising demand for compliance and safety services. New legislations like the Social Housing Regulation Act 2023 and Building Safety Act 2022 mandates stricter safety standards and non-discretionary inspections. David specifically mentioned the Building Safety Act as a reason for the increase in revenue from electrical services in H1 2025 (63% in H1 2025 compared to 47% in H1 2024).

The UK has also set a goal to be net-zero by 2050. This will help drive demand for renewable energy installations through government-funded programs like the Social Housing Decarbonisation Fund.

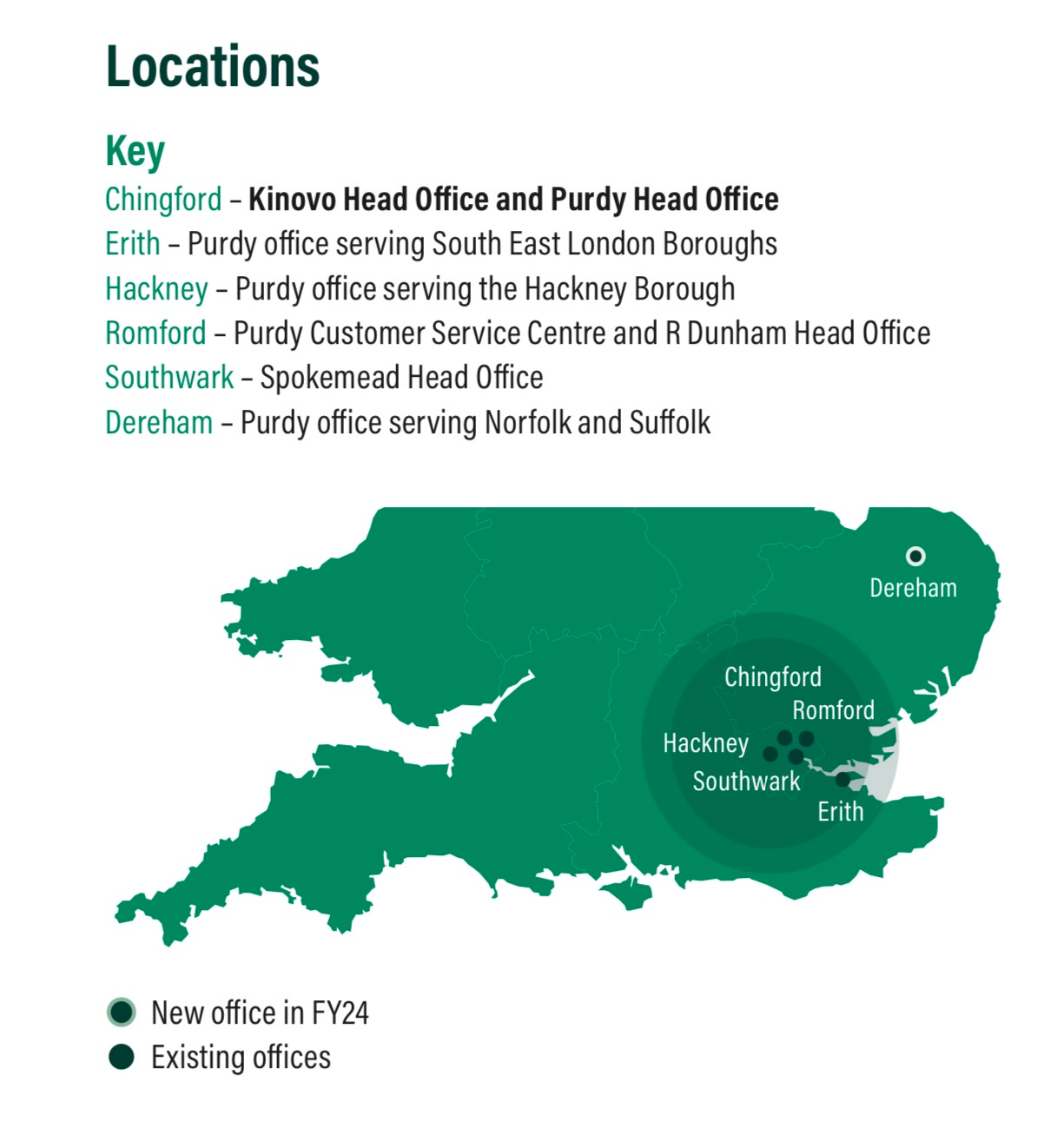

Land and Expand- Kinovo is still a very small company and is mainly located in London and the Southeast.

The company has been strategically expanding as in 2023 they built an office in Dereham, Norfolk (East England) to better service some of their clients in that area.

As part of our strategic plan to expand services in targeted regions and create sustainable bases where we have already secured new long-term contracts to better look after clients and residents. Our investment in the new Dereham office followed direct contracts awards that we won through the Eastern Procurement’s Asset Improvement and Sustainability framework, including Broadlands District Council, Great Yarmouth Borough Council, Saffron Housing and Norwich City Council. - 2024 10K

It appears to be working pretty well already as the company has said that the Norfolk team has secured some short term awards which can convert to long term contract wins.

In H1 2025 Kinovo reported a couple framework wins as well as a few different contracts they got done.

Valuation

On the H1 results call, David said the outlook for full year 2025 EBITDA is £7.3 million. Assuming they reach their outlook at a £42.2 million enterprise value Kinovo would be trading at 5.7x EV/EBITDA

Let’s now take the worst-case scenario and assume Kinovo completely misses guidance and only relies on its three-year visible revenue. Assuming the revenue is split evenly over the next 3 years it would be £58.4 million a year and let’s assume the EBITDA margin goes down from the current 9.8% to 8%. Kinovo would then do £4.67 million in EBITDA which would mean in the worst case scenario they’d still only be trading at 9x EV/EBTDA.

Write ups on Kinovo

As Kinovo is a very small company there aren’t a lot of write ups on it and so far I’ve only found 2.

@Investmentideen (‘‘Paul, not a CFA’’ on twitter)

I originally found out about Kinovo from one of Paul’s tweets and he’s been following the company for quite a while. He wrote this write up about kinovo in 2021 which does a great job explaining the problems Kinovo had before David got there and how David fixed them.

He talks about Kinovo on his twitter account and has some great tweets about the company including this one from when the second largest shareholder Tim Scott tried buying the company for 56 pence a share.

Ampurdan Equity Research wrote this write up in June 2024. While this write up doesn’t include the financials from 2024 or H1 2025 it still does a great job explaining the situation and talks about the companies competitors.

The companies H1 2025 results video

Disclosure- I’m currently long shares of Kinovo PLC

The information provided in this write-up is for informational purposes only and should not be considered financial advice. I am not a licensed financial advisor, and this analysis reflects my personal opinions and research. I may own, or plan to purchase, shares in the stock discussed. Do your own due diligence before making any investment decisions, as stock investing carries risks, including the loss of principal. Past performance is not indicative of future results. Always consult with a qualified financial professional before making any financial decisions.

Nice write -up, thanks! I had the pleasure to have 1-to-1 with David in Dec, and he confirmed that they will launch a big IR campaign after annual report. DCBKENT is truly done then and numbers will be clean, finally.

Better than Buffett!!!!!